2019-06-21 13:33:00 Fri ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Amazon and Google face more intense antitrust scrutiny. In recent times, Justice Department and Federal Trade Commission have reached an internal agreement to conduct independent investigations into these tech titans. Justice Department takes responsibility for Google antitrust matters, and Federal Trade Commission handles Amazon in light of potential consumer harm.

This internal agreement presages intense antitrust scrutiny. Google already faces antitrust fines in Europe due to the E.U. charges that the online search algorithms favor Google-driven software products. U.S. antitrust law focuses on the broader notion of consumer protection; however, smart algorithms help constrain Amazon retail price hikes. Federal Trade Commission conveys concern and suspicion that the sheer size and market power of Amazon may induce anti-competitive effects.

Limiting the market power of tech titans may be one of the few policy domains where Republicans and Democrats find common cause. Democratic presidential candidates such as Joe Biden, Bernie Sanders, and Elizabeth Warren call for greater antitrust scrutiny on the campaign trail. Also, President Trump and other Republicans accuse Amazon and Google of political bias. Justice Department and Federal Trade Commission either stimulate more competition in e-commerce and Internet search, or the regulatory agencies may consider breaking up Amazon and Google.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-07-07 10:33:00 Saturday ET

The east-west tech rivalry intensifies between BATs (Baidu, Alibaba, and Tencent) and FAANGs (Facebook, Apple, Amazon, Netflix, and Google). These Sino-U.S.

2018-02-01 07:38:00 Thursday ET

U.S. senators urge the Trump administration with a bipartisan proposal to prevent the International Monetary Fund (IMF) from bailing out several countries t

2017-11-19 08:37:00 Sunday ET

In 2000, a former law professor at Harvard proposed establishing the Financial Product Safety Commission in order to protect consumer rights in the provisio

2023-06-07 10:27:00 Wednesday ET

Anat Admati and Martin Hellwig raise broad critical issues about bank capital regulation and asset market stabilization. Anat Admati and Martin Hellwig (

2017-10-21 08:45:00 Saturday ET

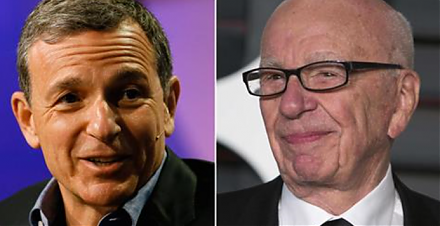

Netflix stares at higher content costs as Disney and Fox hold merger talks. Disney has held talks to acquire most of 21st Century Fox's business equity.

2020-09-11 10:22:00 Friday ET

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools. In recent times, we have completed our fresh website up