Home > Personal Investment Vitae

AYA fintech network platform founder

Location: Taiwan

Gender: Male

Asset investment style: Quantitative fundamental analysis

Market capitalization:

$8,694,520talentsVirtual portfolio value:

$8,543,878talentsNet overall return per annum:

26.26%AYA current rank order:

#1Asset investment philosophy:

I invest in tech value stocks or platform enterprises with substantial network effects, scale economies, and information cascades etc such as Facebook, Apple, Microsoft, Google, Amazon, Nvidia, and Tesla (FAMGANT). All of these platform enterprises reap rewards in the form of both exponential user growth and revenue generation. The long-term fundamental intrinsic value steadily rises over time. One of my favorite stock investment strategies involves buying tech value stocks with competitive moats and first-mover advantages when their share prices fall below the respective book values.

Top 10 profitable stock transactions since January 2020Strategy

| Symbol | Company | Buy | Sell | Share Volume | Return (%) | Profit ($) |

|---|---|---|---|---|---|---|

| TSLA | Tesla Inc. Common Stock | $235.14 | $560.55 | 1,276 | +138.39% | $415,223 |

| Strategy : Elon Musk envisions a bold fantastic future with his professional trifecta of lean enterprises SolarCity, SpaceX, and Tesla. | ||||||

| AAPL | Apple Inc. Common Stock | $187.30 | $248.23 | 3,300 | +35.22% | $201,069 |

| Strategy : Apple retains its niche specialty and competitive moat in mobile devices, online connections, music streams, and apps etc. | ||||||

| NVDA | NVIDIA Corporation Common Stock | $216.31 | $605.09 | 462 | +179.73% | $179,616 |

| Strategy : Nvidia specializes in the continuous flow of lean GPU microchip production for high-performance computers and mobile devices. | ||||||

| PYPL | PayPal Holdings Inc. Common Stock | $92.72 | $258.65 | 1,079 | +178.96% | $179,038 |

| Strategy : PayPal continues to dominate in fintech conglomeration with fast and safe email payments and electronic transfers in America and many other parts of the world. | ||||||

| GOOG | Alphabet Inc. Class C Capital Stock | $1,114.91 | $2,757.57 | 90 | +147.34% | $147,839 |

| Strategy : Google continues to be the long prevalent online search engine with substantially greater AI cloud services such as Gemini, NotebookLM, and Google Cloud machine-learning algorithms. | ||||||

| TSLA | Tesla Inc. Common Stock | $560.55 | $1,374.39 | 178 | +145.19% | $144,864 |

| Strategy : Elon Musk envisions a bold fantastic future with his professional trifecta of lean enterprises SolarCity, SpaceX, and Tesla. | ||||||

| FB | Meta Platforms Inc. Class A Common Stock | $154.47 | $316.92 | 647 | +105.17% | $105,105 |

| Strategy : Meta continues to be the successful conglomeration of social media services with Facebook, Instagram, and Oculus. | ||||||

| AAPL | Apple Inc. Common Stock | $248.23 | $437.50 | 403 | +76.25% | $76,276 |

| Strategy : Apple retains its niche specialty and competitive moat in mobile devices, online connections, music streams, and apps etc. | ||||||

| LN | LINE Corporation | $31.74 | $48.51 | 3,151 | +52.84% | $52,842 |

| Strategy : LINE is the popular WhatsApp-equivalent app with many fun stickers and mobile services. | ||||||

| NVDA | NVIDIA Corporation Common Stock | $148.10 | $216.31 | 676 | +46.06% | $46,110 |

| Strategy : Nvidia specializes in the continuous flow of lean GPU microchip production for high-performance computers and mobile devices. | ||||||

| Sum | $1,547,982 | |||||

Top 10 current stock portfolio positions as of March 2026Strategy

| Symbol | Company | Price | Position | Capitalization |

|---|---|---|---|---|

| IONQ | IonQ Inc. Common Stock | $33.03 | 25,610 | $845,898 |

| TSM | Taiwan Semiconductor Manufacturing Company Ltd. | $336.71 | 2,054 | $691,602 |

| Strategy : The semiconductor trailblazer has surpassed Intel in terms of market capitalization. | ||||

| NET | Cloudflare Inc. Class A Common Stock | $212.11 | 2,550 | $540,880 |

| GS | Goldman Sachs Group Inc. (The) Common Stock | $787.52 | 647 | $509,525 |

| Strategy : Goldman Sachs remains one of the top investment banks in America and many other parts of the world. | ||||

| AAPL | Apple Inc. Common Stock | $255.76 | 1,570 | $401,543 |

| Strategy : Apple retains its niche specialty and competitive moat in mobile devices, online connections, music streams, and apps etc. | ||||

| PSX | Phillips 66 Common Stock | $174.09 | 2,072 | $360,714 |

| Strategy : Phillips 66 is a value stock in the global oil refinery industry (traditional energy). | ||||

| ASML | ASML Holding N.V. New York Registry Shares | $1,351.58 | 250 | $337,895 |

| Strategy : ASML continues to be one of the major pioneers in global semiconductor technology. | ||||

| JPM | JP Morgan Chase & Co. Common Stock | $282.89 | 1,136 | $321,363 |

| Strategy : JPMorgan Chase retains competitive advantages in U.S. retail mortgages, auto loans, credit cards, as well as commercial real estate loans. | ||||

| CSCO | Cisco Systems Inc. Common Stock (DE) | $77.74 | 4,010 | $311,737 |

| MSFT | Microsoft Corporation Common Stock | $401.86 | 719 | $288,937 |

| Strategy : Microsoft retains its competitive moats in software and cloud service provision. | ||||

| Sum | $4,610,094 | |||

Top 20 investors

Top 20 influencers

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| @MaryK | @Ramiro Acahua | @Jose | @Cliff |

| @alin | @Adan Lemus | @Manuel Reyes | @Jack |

| @AYA-Admin | @Ed Sizemore | @Sam | @Emily Rochefort |

| @Nicolas Lopez | @Esteban Coronel | @Saab | @Mary |

| @Andres Diaz Vega | @Pierre Desir | @Manuel Roque | @AYA-Admin |

Top 20 followers

2019-12-30 11:28:00 Monday ET

AYA Analytica finbuzz podcast channel on YouTube December 2019 In this podcast, we discuss several topical issues as of December 2019: (1) The Trump adm

2018-11-21 11:36:00 Wednesday ET

Apple upstream suppliers from Foxconn and Pegatron to Radiance and Lumentum experience sharp share price declines during the Christmas 2017 holiday quarter.

2018-05-15 08:40:00 Tuesday ET

Net neutrality rules continue to revolve around the Trump administration's current IT agenda of 5G telecom transformation. Republican Senate passes the

2022-11-25 09:29:00 Friday ET

Uniform field theory of corporate finance While the agency and precautionary-motive stories are complementary, these stories can be nested as special cas

2019-03-19 12:35:00 Tuesday ET

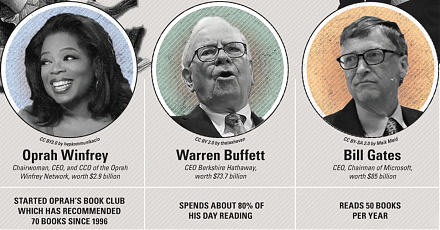

U.S. tech titans increasingly hire PhD economists to help solve business problems. These key tech titans include Facebook, Amazon, Microsoft, Google, Apple,

2018-10-25 10:36:00 Thursday ET

Trump tariffs begin to bite U.S. corporate profits from Ford and Harley-Davidson to Caterpillar and Walmart etc. U.S. corporate profit growth remains high a