Home > Personal Investment Vitae

Location: United States

Gender: Female

Asset investment style: Quantitative technical analysis

Market capitalization:

$7,643,835talentsVirtual portfolio value:

$4,677,090talentsNet overall return per annum:

18.26%AYA current rank order:

#12Asset investment philosophy:

Rose Prince trades U.S. stocks with the top #201 to #500 positive alpha signals.

Top 10 profitable stock transactions since January 2020Strategy

| Symbol | Company | Buy | Sell | Share Volume | Return (%) | Profit ($) |

|---|---|---|---|---|---|---|

| VATE | INNOVATE Corp. Common Stock | $0.53 | $4.14 | 91,603 | +681.13% | $330,687 |

| RMBL | RumbleOn Inc. Class B Common Stock | $0.36 | $7.95 | 12,852 | +2,108.33% | $97,547 |

| LGVN | Longeveron Inc. Class A Common Stock | $3.45 | $26.25 | 3,340 | +660.87% | $76,152 |

| LSCC | Lattice Semiconductor Corporation Common Stock | $6.97 | $48.04 | 1,665 | +589.24% | $68,382 |

| TUEM | Tuesday Morning Corp. Common Stock | $0.12 | $0.69 | 103,558 | +475.00% | $59,028 |

| NTZ | Natuzzi S.p.A. | $2.21 | $11.92 | 5,254 | +439.37% | $51,016 |

| GNRC | Generac Holdlings Inc. Common Stock | $42.64 | $219.38 | 272 | +414.49% | $48,073 |

| CDNS | Cadence Design Systems Inc. Common Stock | $29.82 | $150.85 | 389 | +405.87% | $47,081 |

| MPWR | Monolithic Power Systems Inc. Common Stock | $85.91 | $392.24 | 135 | +356.57% | $41,355 |

| BBX | BBX Capital Corporation | $2.54 | $14.54 | 2,191 | +472.44% | $26,292 |

| Sum | $845,613 |

Top 10 current stock portfolio positions as of March 2026Strategy

| Symbol | Company | Price | Position | Capitalization |

|---|---|---|---|---|

| HIMS | Hims & Hers Health Inc. Class A Common Stock | $23.84 | 1,582 | $37,714 |

| IMMX | Immix Biopharma Inc. Common Stock | $10.11 | 2,848 | $28,793 |

| DDD | 3D Systems Corporation Common Stock | $2.39 | 11,908 | $28,460 |

| NET | Cloudflare Inc. Class A Common Stock | $212.11 | 133 | $28,210 |

| CNR | Core Natural Resources Inc. Common Stock | $100.04 | 280 | $28,011 |

| CRWD | CrowdStrike Holdings Inc. Class A Common Stock | $441.54 | 61 | $26,933 |

| ESCA | Escalade Incorporated Common Stock | $16.57 | 1,596 | $26,445 |

| VLO | Valero Energy Corporation Common Stock | $235.81 | 112 | $26,410 |

| KRMN | Karman Holdings Inc. Common Stock | $98.98 | 260 | $25,734 |

| ETON | Eton Pharmaceuticals Inc. Common Stock | $19.02 | 1,352 | $25,715 |

| Sum | $282,425 |

Top 20 investors

Top 20 influencers

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| @alin | |||

| @Andy Yeh Alpha | |||

Top 20 followers

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| @Bob Hessonwitz | @Vincent Bonsai | @Jack hsu | @Apple |

| @Will | @Darren | @AJ Yeh | @ZimboDave |

| @Luminoalgo | @Sandra Martinazzison | @MRCASH1991 | @Bloom789 |

| @Duke | @Mo | @Amy | @Andy Cheung |

| @TechBull22 | @Ru-Ting Yeh | @Syl_will | @George |

2020-03-05 08:28:00 Thursday ET

The Stanford computer science overlords Larry Page and Sergey Brin design and develop Google as an Internet search company. Janet Lowe (2009) Google s

2019-08-07 08:32:00 Wednesday ET

Our fintech finbuzz analytic report shines fresh light on the current global economic outlook. As of Summer-Fall 2019, the current analytic report focuses o

2025-10-08 11:34:00 Wednesday ET

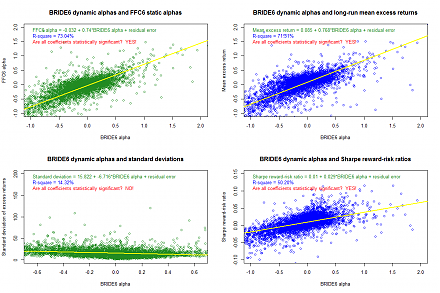

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2022-09-25 09:34:00 Sunday ET

Main reasons for share repurchases Temporary market undervaluation often induces corporate incumbents to initiate a share repurchase program to boost the

2023-01-09 10:31:00 Monday ET

Response to USPTO fintech patent protection As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S. utility patent

2019-08-03 09:28:00 Saturday ET

U.S. inflation has become sustainably less than the 2% policy target in recent years. As Harvard macro economist Robert Barro indicates, U.S. inflation has