Home > Personal Investment Vitae

Location: Taiwan

Gender: Male

Asset investment style: Qualitative technical analysis

Market capitalization:

$1,004,818talentsVirtual portfolio value:

$1,001,493talentsNet overall return per annum:

0.02%AYA current rank order:

#21Top 10 profitable stock transactions since January 2020Strategy

| Symbol | Company | Buy | Sell | Share Volume | Return (%) | Profit ($) |

|---|---|---|---|---|---|---|

| AAPL | Apple Inc. Common Stock | $207.48 | $437.50 | 1 | +110.86% | $230 |

| Sum | $230 |

Top 10 current stock portfolio positions as of March 2026Strategy

| Symbol | Company | Price | Position | Capitalization |

|---|---|---|---|---|

| META | Meta Platforms Inc. Class A Common Stock | $638.18 | 10 | $6,381 |

| Sum | $6,381 |

Top 20 influencers

2024-03-19 03:35:58 Tuesday ET

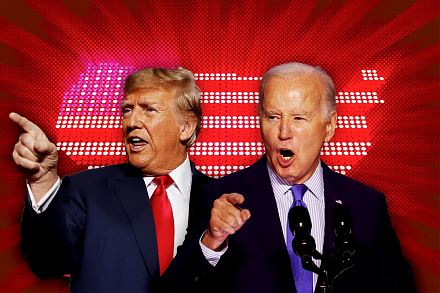

U.S. presidential election: a re-match between Biden and Trump in November 2024 We delve into the 5 major economic themes of the U.S. presidential electi

2018-08-21 11:40:00 Tuesday ET

President Trump criticizes his new Fed Chair Jerome Powell for accelerating the current interest rate hike with greenback strength. This criticism overshado

2023-06-14 10:26:00 Wednesday ET

Daron Acemoglu and James Robinson show that good inclusive institutions contribute to better long-run economic growth. Daron Acemoglu and James Robinson

2018-04-07 09:36:00 Saturday ET

Facebook CEO Mark Zuckerberg testifies in Congress to rise up to the challenge of public outrage in response to the Cambridge Analytica data debacle and use

2018-02-07 06:38:00 Wednesday ET

The new Fed chairman Jerome Powell faces a new challenge in the form of both core CPI and CPI inflation rate hikes toward 1.8%-2.1% year-over-year with stro

2023-12-09 08:28:00 Saturday ET

International trade, immigration, and elite-mass conflict The elite model portrays public policy as a reflection of the interests and values of elites. I