Home > Personal Investment Vitae

Location: United States

Gender: Female

Asset investment style: Qualitative fundamental analysis

Market capitalization:

$8,108,843talentsVirtual portfolio value:

$5,081,494talentsNet overall return per annum:

19.35%AYA current rank order:

#4Asset investment philosophy:

Laura Hermes trades U.S. stocks with the top #51 to #500 positive alpha signals.

Top 10 profitable stock transactions since January 2020Strategy

| Symbol | Company | Buy | Sell | Share Volume | Return (%) | Profit ($) |

|---|---|---|---|---|---|---|

| RMBL | RumbleOn Inc. Class B Common Stock | $0.36 | $7.95 | 51,225 | +2,108.33% | $388,798 |

| HAO | Haoxi Health Technology Limited Class A Ordinary Shares | $0.15 | $2.50 | 86,720 | +1,566.67% | $203,792 |

| LSCC | Lattice Semiconductor Corporation Common Stock | $6.97 | $48.04 | 4,471 | +589.24% | $183,624 |

| SXTP | 60 Degrees Pharmaceuticals Inc. Common Stock | $0.15 | $1.34 | 119,533 | +793.33% | $142,244 |

| NTZ | Natuzzi S.p.A. | $2.21 | $11.92 | 14,103 | +439.37% | $136,940 |

| VATE | INNOVATE Corp. Common Stock | $0.53 | $4.14 | 33,830 | +681.13% | $122,126 |

| BQ | Boqii Holding Limited American Depositary Shares representing Class A Ordinary Shares | $0.36 | $3.36 | 36,133 | +833.33% | $108,399 |

| BQ | Boqii Holding Limited Class A Ordinary Shares | $0.36 | $3.36 | 36,133 | +833.33% | $108,399 |

| SSNT | SilverSun Technologies Inc. Common Stock | $18.59 | $130.48 | 801 | +601.88% | $89,624 |

| LGVN | Longeveron Inc. Class A Common Stock | $3.45 | $26.25 | 2,526 | +660.87% | $57,593 |

| Sum | $1,541,539 |

Top 10 current stock portfolio positions as of March 2026Strategy

| Symbol | Company | Price | Position | Capitalization |

|---|---|---|---|---|

| TRVI | Trevi Therapeutics Inc. Common Stock | $13.30 | 4,796 | $63,786 |

| TREE | LendingTree Inc. Common Stock | $42.90 | 1,478 | $63,406 |

| PLTR | Palantir Technologies Inc. Class A Common Stock | $157.16 | 402 | $63,178 |

| WDAY | Workday, Inc. | $151.04 | 413 | $62,379 |

| ZETA | Zeta Global Holdings Corp. Class A Common Stock | $18.84 | 3,259 | $61,399 |

| MHH | Mastech Digital Inc Common Stock | $6.66 | 9,194 | $61,232 |

| HIMS | Hims & Hers Health Inc. Class A Common Stock | $15.74 | 3,805 | $59,890 |

| VAC | Marriott Vacations Worldwide Corporation Common Stock | $70.50 | 849 | $59,854 |

| IT | Gartner Inc. Common Stock | $169.00 | 351 | $59,319 |

| VEEV | Veeva Systems Inc. Class A Common Stock | $195.49 | 303 | $59,233 |

| Sum | $613,676 |

Top 20 investors

Top 20 influencers

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| @alin | |||

| @John Fourier | |||

| @Andy Yeh Alpha | |||

| @Chanel Holden | |||

Top 20 followers

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| @Bob Hessonwitz | @Vincent Bonsai | @Jack hsu | @Apple |

| @Will | @Darren | @AJ Yeh | @ZimboDave |

| @Luminoalgo | @Sandra Martinazzison | @MRCASH1991 | @Bloom789 |

| @Duke | @Mo | @Amy | @Andy Cheung |

| @TechBull22 | @Ru-Ting Yeh | @Syl_will | @George |

2024-05-27 03:23:34 Monday ET

Stock Synopsis: Life insurers emphasize profit margins over sales growth rates. We review and analyze the recent market share data in the U.S. life insur

2019-08-10 21:44:00 Saturday ET

McKinsey Global Institute analyzes 315 U.S. cities and 3,000 counties in terms of how tech automation affects their workers in the next 5 to 10 years. This

2018-01-15 07:35:00 Monday ET

Treasury Secretary Steven Mnuchin welcomes a weak U.S. dollar amid pervasive fears of an open trade war between America and China. At the World Economic For

2019-10-01 11:33:00 Tuesday ET

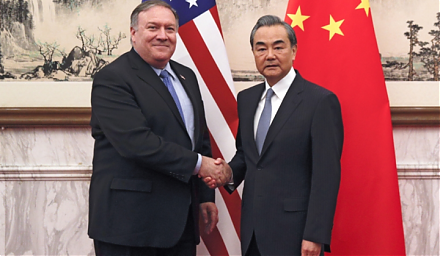

The Trump administration postpones increasing 25% to 30% tariffs on $250 billion Chinese imports after China extends an olive branch to de-escalate Sino-Ame

2019-01-09 07:33:00 Wednesday ET

Apple revises down its global sales revenue estimate to $83 billion due to subpar smartphone sales in China. Apple CEO Tim Cook points out the fact that he

2020-05-21 11:30:00 Thursday ET

Most blue-ocean strategists shift fundamental focus from current competitors to alternative non-customers with new market space. W. Chan Kim and Renee Ma