Home > Personal Investment Vitae

Location: United States

Gender: Male

Asset investment style: Quantitative fundamental analysis

Market capitalization:

$7,472,197talentsVirtual portfolio value:

$4,477,390talentsNet overall return per annum:

17.71%AYA current rank order:

#18Asset investment philosophy:

John Fourier trades U.S. stocks with the top #276 to #500 positive alpha signals.

Top 10 profitable stock transactions since January 2020Strategy

| Symbol | Company | Buy | Sell | Share Volume | Return (%) | Profit ($) |

|---|---|---|---|---|---|---|

| SXTP | 60 Degrees Pharmaceuticals Inc. Common Stock | $0.15 | $1.34 | 129,826 | +793.33% | $154,493 |

| BQ | Boqii Holding Limited American Depositary Shares representing Class A Ordinary Shares | $0.36 | $3.36 | 45,111 | +833.33% | $135,333 |

| BQ | Boqii Holding Limited Class A Ordinary Shares | $0.36 | $3.36 | 45,111 | +833.33% | $135,333 |

| VATE | INNOVATE Corp. Common Stock | $0.53 | $4.14 | 36,743 | +681.13% | $132,642 |

| SSNT | SilverSun Technologies Inc. Common Stock | $18.59 | $130.48 | 857 | +601.88% | $95,890 |

| RMBL | RumbleOn Inc. Class B Common Stock | $0.36 | $7.95 | 9,925 | +2,108.33% | $75,331 |

| AXSM | Axsome Therapeutics Inc. Common Stock | $4.60 | $31.75 | 1,441 | +590.22% | $39,123 |

| LSCC | Lattice Semiconductor Corporation Common Stock | $6.97 | $48.04 | 951 | +589.24% | $39,058 |

| SQ | Block Inc. Class A Common Stock | $14.50 | $99.54 | 457 | +586.48% | $38,863 |

| FIVN | Five9 Inc. Common Stock | $16.31 | $110.10 | 406 | +575.05% | $38,079 |

| Sum | $884,145 |

Top 10 current stock portfolio positions as of March 2026Strategy

| Symbol | Company | Price | Position | Capitalization |

|---|---|---|---|---|

| MGRT | Mega Fortune Company Limited Ordinary Shares | $8.49 | 2,465 | $20,927 |

| TTD | The Trade Desk Inc. Class A Common Stock | $29.28 | 647 | $18,944 |

| ASTH | Astrana Health Inc. Common Stock | $24.91 | 759 | $18,906 |

| UMAC | Unusual Machines Inc. Common Stock | $16.45 | 1,130 | $18,588 |

| TRVI | Trevi Therapeutics Inc. Common Stock | $13.30 | 1,339 | $17,808 |

| INTU | Intuit Inc. Common Stock | $481.17 | 37 | $17,803 |

| IMMX | Immix Biopharma Inc. Common Stock | $9.29 | 1,912 | $17,762 |

| AGH | Aureus Greenway Holdings Inc. Common Stock | $4.88 | 3,639 | $17,758 |

| TREE | LendingTree Inc. Common Stock | $42.90 | 412 | $17,674 |

| PLTR | Palantir Technologies Inc. Class A Common Stock | $157.16 | 112 | $17,601 |

| Sum | $183,771 |

Top 20 investors

Top 20 influencers

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| @Andy Yeh Alpha | |||

Top 20 followers

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| @Bob Hessonwitz | @Vincent Bonsai | @Jack hsu | @Apple |

| @Will | @Darren | @AJ Yeh | @ZimboDave |

| @Luminoalgo | @Sandra Martinazzison | @MRCASH1991 | @Bloom789 |

| @Duke | @Mo | @Amy | @Andy Cheung |

| @TechBull22 | @Ru-Ting Yeh | @Syl_will | @George |

Top 20 favorite stocks

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| $ZIM | |||

2017-11-13 07:42:00 Monday ET

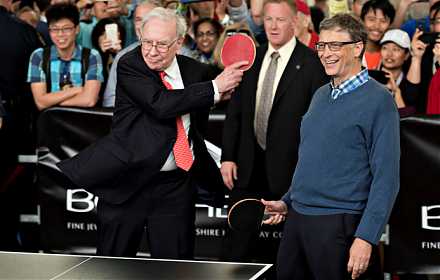

Top 2 wealthiest men Bill Gates and Warren Buffett shared their best business decisions in a 1998 panel discussion with students at the University of Washin

2019-01-13 12:37:00 Sunday ET

We need crowdfunds to support our next responsive web design and iOS and Android app development. Upon successful campaign completion, we will provide an eb

2019-03-23 09:31:00 Saturday ET

Congresswoman Alexandria Ocasio-Cortez proposes greater public debt finance with minimal tax increases for the Green New Deal. In accordance with the modern

2019-02-02 11:36:00 Saturday ET

The Trump administration teams up with western allies to bar HuaWei and other Chinese tech firms from building the 5G high-speed infrastructure due to natio

2018-03-11 08:27:00 Sunday ET

At 89 years old, Hong Kong billionaire Li Ka-Shing announces his retirement in March 2018. With a personal net worth of $35 billion, Li has an incredible ra

2017-12-17 11:41:00 Sunday ET

Warren Buffett points out that it is important to invest in oneself. Learning about oneself empowers him or her to lead a meaningful life. This valuable inv