Home > Personal Investment Vitae

Market capitalization:

$1,000,000talentsVirtual portfolio value:

$1,000,000talentsNet overall return per annum:

0.00%AYA current rank order:

#216Top 20 investors

Top 20 influencers

2019-03-25 17:30:00 Monday ET

America seeks to advance the global energy dominance agenda by toppling Saudi Arabia as the top oil exporter by 2024. The International Energy Agency (IEA)

2020-11-22 11:30:00 Sunday ET

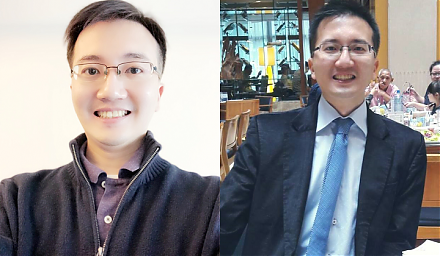

A brief biography of Andy Yeh Andy Yeh is responsible for ensuring maximum sustainable member growth within the Andy Yeh Alpha (AYA) fintech network pla

2017-11-23 10:42:00 Thursday ET

As the TV host of Mad Money, Jim Cramer provides 5 key reasons against the purchase and use of cryptocurrencies such as Bitcoin. First, no one knows the ano

2019-08-06 07:28:00 Tuesday ET

Former basketball star Shaq O'Neal has almost quadrupled his net worth once he learns and applies an ingenious investment strategy from Amazon Founder J

2023-05-31 11:27:00 Wednesday ET

What are the top global risks in trade, finance, and technology? In this macro report, we focus on the current global risks from inflation and growth con

2023-12-10 09:23:00 Sunday ET

U.S. federalism and domestic institutional arrangements A given country is federal when both of its national and sub-national governments exercise separa