Walmart Inc. helps people around the world save money and live better by providing the opportunity to shop in both retail stores and through eCommerce, and to access its other service offerings. Through innovation, it strives to continuously improve a customer-centric experience that seamlessly integrates its eCommerce and retail stores in an omni-channel offering that saves time for customers. By leading on price, it earns the trust of customers every day by providing a broad assortment of quality merchandise and services at everyday low prices (EDLP). EDLP is the company's pricing philosophy under which it prices items at a low price every day. Everyday low cost (EDLC) is the company's commitment to control expenses so its cost savings can be passed along to customers. It has 3 reportable segments: Walmart U.S., Walmart International and Sam's Club. It maintains principal offices in Bentonville, Arkansas....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-05-09 08:31:00 Wednesday ET

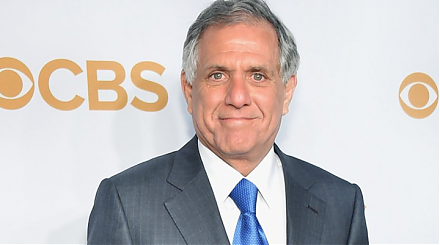

CBS and its special committee of independent directors have decided to sue the Redstone controlling shareholders because these directors might have breached

2027-04-30 12:31:00 Friday ET

In recent years, the current AI-driven stock market rally may or may not turn out to be another major asset bubble in global human history. For the pract

2022-04-15 10:32:00 Friday ET

Corporate investment management This review of corporate investment literature focuses on some recent empirical studies of M&A, capital investm

2018-09-27 11:41:00 Thursday ET

Michael Kors pays $2.3 billion to acquire the Italian elite fashion brand Versace. In accordance with Michael Kors's 5-year plan, the joint company grow

2023-07-07 10:29:00 Friday ET

Louis Kaplow strives to find a delicate balance between efficiency gains and redistributive taxes in the social welfare function. Louis Kaplow (2010)

2024-10-14 11:33:00 Monday ET

Stock Synopsis: Video games continue to take both screen time and monetization from many other forms of entertainment. We are broadly positive about the