Wellesley Bancorp, Inc. operates as the bank holding company for Wellesley Bank that provides various financial services to individuals, non-profit organizations, small businesses, and other entities in eastern Massachusetts. Its deposit products include noninterest-bearing demand deposits, such as checking accounts; interest-bearing demand accounts comprising negotiable order of withdrawal and money market accounts; savings accounts; and certificates of deposit. The company also offers residential mortgage loans, commercial real estate loans, and construction loans, as well as home equity lines of credit; other consumer loans that consist of fixed-rate second mortgage loans, automobile loans, loans secured by passbook or certificate accounts, and overdraft loans; and commercial business loans, such as term loans, revolving lines of credit, and equipment loans. In addition, it provides investment advisory services and remote capture products; and engages in buying, selling, and holding securities. As of December 31, 2018, Wellesley Bancorp, Inc. operated through executive offices and five full service branch offices located in Wellesley, Newton, and Boston; limited- hour branch service office in Needham, Massachusetts; and wealth management offices located in Wellesley. The company was founded in 1911 and is headquartered in Wellesley, Massachusetts....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-04-07 09:36:00 Saturday ET

Facebook CEO Mark Zuckerberg testifies in Congress to rise up to the challenge of public outrage in response to the Cambridge Analytica data debacle and use

2019-03-17 14:35:00 Sunday ET

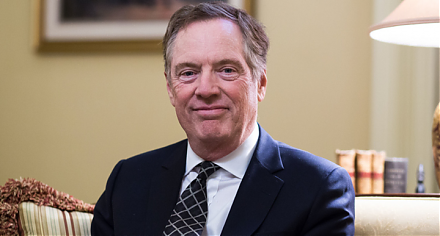

U.S. trade rep Robert Lighthizer proposes America to require regular touchpoints to ensure Sino-U.S. trade deal enforcement. America has to maintain the thr

2019-06-11 12:33:00 Tuesday ET

Dallas Federal Reserve Bank President Robert Kaplan expects the U.S. economy to grow at 2.2%-2.5% in 2019-2020 as inflation rises a bit. In an interview wit

2018-07-13 09:41:00 Friday ET

Yale economist Stephen Roach warns that America has much to lose from the current trade war with China for a few reasons. First, America is highly dependent

2020-10-13 08:27:00 Tuesday ET

Agile lean enterprises strive to design radical business models to remain competitive in the face of nimble startups and megatrends. Carsten Linz, Gunter

2019-05-11 10:28:00 Saturday ET

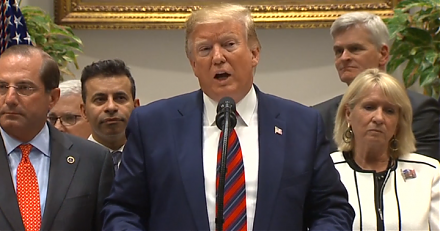

The Trump administration still expects to reach a Sino-U.S. trade agreement with a better mechanism for intellectual property protection and enforcement. Pr