Warner Bros. Discovery is a media and entertainment company which creates and distributes portfolio of content and brands across television, film and streaming. The company's brands and products includes Discovery Channel, discovery , CNN, CNN , DC, Eurosport, HBO, HBO Max, HGTV, Food Network, Investigation Discovery, TLC, TNT, TBS, truTV, Travel Channel, MotorTrend, Animal Planet, Science Channel, Warner Bros. Pictures, New Line Cinema, Cartoon Network, Adult Swim, Turner Classic Movies and others. Warner Bros. Discovery, formerly known as Discovery Inc., is based in NEW YORK....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-09-21 09:41:00 Friday ET

Former World Bank and IMF chief advisor Anne Krueger explains why the Trump administration's current tariff tactics undermine the multilateral global tr

2023-10-21 11:32:00 Saturday ET

Walter Scheidel indicates that persistent European fragmentation after the collapse of the Roman Empire leads to modern economic growth and development.

2018-06-04 08:38:00 Monday ET

Microsoft acquires GitHub, a software development platform that has been widely shared-and-used by more than 28 million programmers worldwide. GitHub's

2020-03-19 13:39:00 Thursday ET

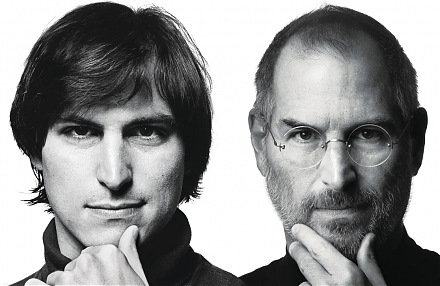

The business legacy and sensitivity of Steve Jobs can transform smart mobile devices with Internet connectivity, music and video content curation, and digit

2019-02-01 15:35:00 Friday ET

Our proprietary alpha investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implem

2019-06-17 11:25:00 Monday ET

To secure better economic arrangements with European Union, Jeremy Corbyn encourages Labour legislators to back a second referendum on Brexit. In recent tim