2018-09-25 10:35:00 Tue ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Sirius XM pays $3.5 billion shares to acquire the music app company Pandora. This acquisition would form the largest audio entertainment company worldwide. Building on its 15% equity stakes in Pandora, Sirius initiates a stock acquisition with an exchange ratio of 1.44 Sirius shares for each share in Pandora. In response, Sirius experiences a 7% stock price dip while Pandora share price trades at a hefty 13% premium.

This deal generates several synergies between Sirius XM and Pandora. First, the broader music network includes 100 million active users. Sirius now has 35 million subscribers in North America and 23 million users on an annual trial. Meanwhile, Pandora keeps 70 million active users and 6 million premium subscribers. Massive network effects can result from this merger.

Second, Sirius taps into Pandora's mobile and web advertisements, and Pandora benefits from Sirius's greater financial capital and in-car presence. As the company cross-sells its music services to build new audio packages, Sirius can operate both brands for better user experience.

Third, the Pandora-Sirius combination better holds up against intense competition from Apple, Spotify, and Amazon as the latter major platform orchestrators invest aggressively in their music services. Subject to customary shareholder approval and regulatory scrutiny, the Pandora-Sirius deal can close in early-2019.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-05-13 12:38:00 Monday ET

Brent crude oil prices spike to $70-$75 per barrel after the Trump administration stops waiving economic sanctions on Iranian oil exports. U.S. State Secret

2019-09-23 12:25:00 Monday ET

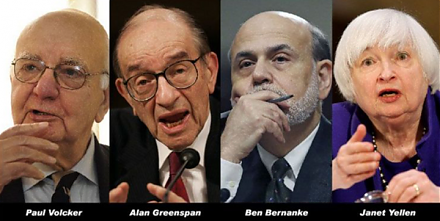

Volcker, Greenspan, Bernanke, and Yellen contribute to a Wall Street Journal op-ed on monetary policy independence. These former Federal Reserve chiefs unit

2018-08-05 12:34:00 Sunday ET

JPMorgan Chase CEO Jamie Dimon sees great potential for 10-year government bond yields to rise to 5% in contrast to the current 3% 10-year Treasury bond yie

2023-02-21 08:27:00 Tuesday ET

Mark Granovetter follows the key principles of modern economic sociology to analyze social relations and economic phenomena. Mark Granovetter (2017) &

2022-03-15 10:32:00 Tuesday ET

Capital structure theory and practice The genesis of modern capital structure theory traces back to the seminal work of Modigliani and Miller (1958

2019-08-03 09:28:00 Saturday ET

U.S. inflation has become sustainably less than the 2% policy target in recent years. As Harvard macro economist Robert Barro indicates, U.S. inflation has