Vodafone AirTouch Plc is the world's largest international mobile communications firm. Their primary operation is in digital and analog cellular telephone networks of Vodafone....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-08-18 11:33:00 Sunday ET

House Judiciary Committee summons senior executive reps of the tech titans to assess online platforms and their market power. These companies are Facebook,

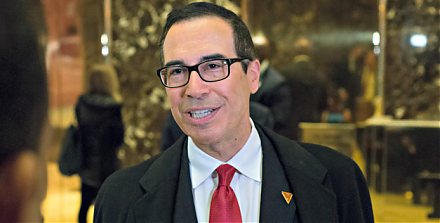

2017-05-25 08:35:00 Thursday ET

Treasury Secretary Steve Mnuchin has released a 147-page report on financial deregulation under the Trump administration. This financial deregulation seeks

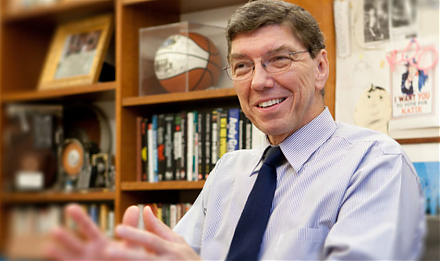

2019-11-21 11:34:00 Thursday ET

Berkeley macro economist Brad DeLong sees no good reasons for an imminent economic recession with mass unemployment and even depression. The current U.S. ec

2020-05-14 12:35:00 Thursday ET

Disruptive innovators can better compete against luck by figuring out why customers hire products and services to accomplish jobs. Clayton Christensen, T

2017-07-25 10:44:00 Tuesday ET

NerdWallet's new simulation suggests that a 25-year-old millennial who earns an inflation-free base salary of $40,456 and saves 15% each year faces a 99

2022-03-25 09:34:00 Friday ET

Corporate cash management The empirical corporate finance literature suggests four primary motives for firms to hold cash. These motives include the tra