Companhia Sider'rgica Nacional or National Steel Company is one of the largest fully integrated steel producers in Brazil and Latin America in terms of crude steel production. The Steel segment comprises a portfolio of diverse products and provides an international footprint by means of international subsidiaries and exports from Brazil. In flat steel segment, NSC is a fully-integrated steelmaker. Steelworks produces a broad line of steel products, including slabs, hot and cold rolled, galvanized and tin mill products for the distribution, packaging, automotive, home appliance and construction industries. In Mining unit, NSC owns a number of high quality iron ore mines, strategically located within Brazil's 'Iron Ore Quadrangle'. In Logistics unit, NSC's vertical integration strategy and the synergies among business units are strongly dependent on the logistics needed to guarantee the transportation of inputs at low cost....

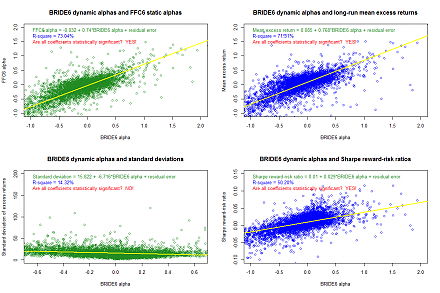

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2017-06-09 06:37:00 Friday ET

To complement President Trump's pro-business economic policies such as low taxation, new infrastructure, greater job creation, and technological in

2019-06-09 11:29:00 Sunday ET

St Louis Federal Reserve President James Bullard indicates that his ideal baseline scenario remains a mutually beneficial China-U.S. trade deal. Bullard ind

2023-06-07 10:27:00 Wednesday ET

Anat Admati and Martin Hellwig raise broad critical issues about bank capital regulation and asset market stabilization. Anat Admati and Martin Hellwig (

2019-02-25 12:41:00 Monday ET

Chicago financial economist Raghuram Rajan views communities as the third pillar of liberal democracy in addition to open markets and states. Rajan suggests

2023-01-11 09:26:00 Wednesday ET

Addendum on USPTO fintech patent protection and accreditation As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S

2024-03-26 09:30:00 Tuesday ET

Stock Synopsis: ESG value and momentum stock market portfolio strategies Since 2013, we have been delving into the broad topics of ESG (Environmental, So