Blue Owl Capital is an alternative asset manager which provides investors access to direct lending and GP capital solutions strategies through a variety of vehicles. Blue Owl Capital, formerly known as Altimar Acquisition Corporation, is based in NEW YORK....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-05-13 12:38:00 Monday ET

Brent crude oil prices spike to $70-$75 per barrel after the Trump administration stops waiving economic sanctions on Iranian oil exports. U.S. State Secret

2018-07-07 10:33:00 Saturday ET

The east-west tech rivalry intensifies between BATs (Baidu, Alibaba, and Tencent) and FAANGs (Facebook, Apple, Amazon, Netflix, and Google). These Sino-U.S.

2020-03-19 13:39:00 Thursday ET

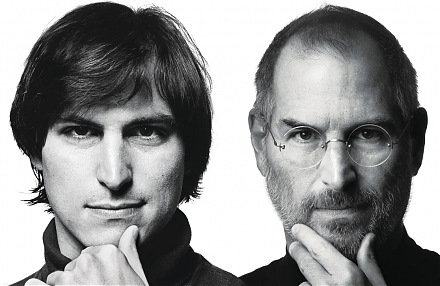

The business legacy and sensitivity of Steve Jobs can transform smart mobile devices with Internet connectivity, music and video content curation, and digit

2019-07-09 15:14:00 Tuesday ET

The Chinese new star board launches for tech firms to list at home. The Nasdaq-equivalent new star board serves as a key avenue for Chinese tech companies t

2018-08-05 12:34:00 Sunday ET

JPMorgan Chase CEO Jamie Dimon sees great potential for 10-year government bond yields to rise to 5% in contrast to the current 3% 10-year Treasury bond yie

2019-11-03 12:30:00 Sunday ET

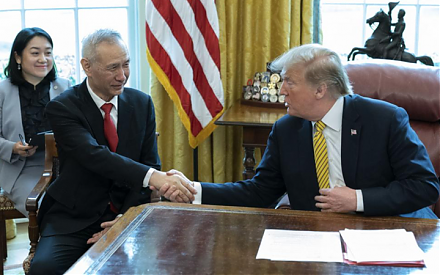

Chinese trade delegation offers to boost purchases of U.S. agricultural products to reach an interim trade deal with the Trump administration. Chinese Vice