Matinas BioPharma is a clinical-stage biopharmaceutical company focused on enabling the delivery of life-changing medicines using its LNC platform technology. The Company's proprietary, disruptive technology utilizes lipid nano-crystals which can encapsulate small molecule drugs, oligonucleotides, vaccines, peptides, proteins and other medicines potentially making them safer, more tolerable, less toxic and orally bioavailable. The Company's lead anti-fungal product candidate, MAT2203, utilizes its proprietary lipid nano-crystal formulation technology for the safe and effective delivery of the broad-spectrum fungicidal agent, amphotericin B. Based on the positive patient clinical data reported in 2017, Matinas is preparing for a potential Phase 2 pivotal trial of MAT2203 for prevention of invasive fungal infections in patients with acute lymphoblastic leukemia....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2022-03-25 09:34:00 Friday ET

Corporate cash management The empirical corporate finance literature suggests four primary motives for firms to hold cash. These motives include the tra

2019-03-27 11:28:00 Wednesday ET

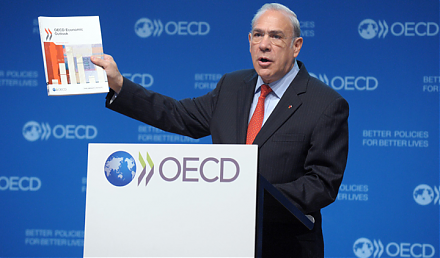

OECD cuts the global economic growth forecast from 3.5% to 3.3% for the current fiscal year 2019-2020. The global economy suffers from economic protraction

2020-06-03 09:31:00 Wednesday ET

Lean enterprises often try to incubate disruptive innovations with iterative continuous improvements and inventions over time. Trevor Owens and Obie Fern

2018-11-19 09:38:00 Monday ET

The Trump administration mulls over antitrust actions against Amazon, Facebook, and Google. President Trump indicates that the $5 billion fine against Googl

2025-07-05 11:23:00 Saturday ET

Former New York Times science author and Harvard psychologist Daniel Goleman explains why working with emotional intelligence helps hone our social skills f

2018-01-06 07:32:00 Saturday ET

Subsequent to the Trump tax cuts for Christmas in December 2017, the one-year-old Trump presidency now aims to make progress on health care, infrastructure,