Merck & Co. boasts more than six blockbuster drugs in its portfolio with PD-L1 inhibitor, Keytruda, approved for several types of cancer. Keytruda has played an instrumental role in driving Merck's steady revenue growth in the past few years. Well-known products in Merck's portfolio include Keytruda, Simponi , Januvia and Janumet, Bridion, Isentress, ProQuad, Gardasil, Pneumovax 23, RotaTeq and Belsomra. Merck made its biggest acquisition of Schering-Plough and sold off its Consumer Care business to Bayer. Other key acquisitions include Idenix Pharmaceuticals, Cubist Pharmaceuticals, Rigontec, ArQule and Acceleron Pharma. IMerck spun off products from its Women's Health unit, legacy drugs and biosimilar products into a new publicly traded company called Organon & Co....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-05-14 12:31:00 Sunday ET

Paul Samuelson defines the mathematical evolution of economic price theory and thereby influences many economists in business cycle theory and macro asset m

2020-07-12 08:30:00 Sunday ET

The lean CEO encourages iterative continuous improvements and collaborative teams to innovate around core value streams. Jacob Stoller (2015)

2018-06-08 13:35:00 Friday ET

The Federal Reserve delivers a second interest rate hike to 1.75%-2% and then expects subsequent rate increases in September and December 2018 to dampen inf

2019-11-07 14:36:00 Thursday ET

America expects to impose punitive tariffs on $7.5 billion European exports due to the recent WTO rule violation of illegal plane subsidies. World Trade Org

2019-04-30 07:15:00 Tuesday ET

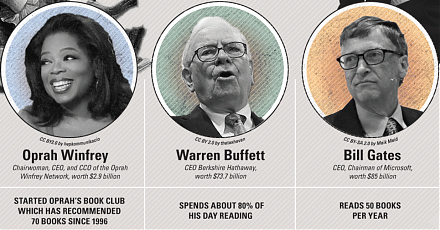

Through our AYA fintech network platform, we share numerous insightful posts on personal finance, stock investment, and wealth management. Our AYA finte

2017-03-21 09:37:00 Tuesday ET

Trump and Xi meet in the most important summit on earth this year. Trump has promised to retaliate against China's currency misalignment, steel trade