HEICO Corporation, is one of the world's leading manufacturers of Federal Aviation Administration approved jet engine and aircraft component replacement parts. It also manufactures various types of electronic equipment for the aviation, defense, space, medical, telecommunications and electronics industries. The company's products are found on large commercial aircraft, regional, business and military aircraft, as well as on a large variety of industrial turbines, targeting systems, missiles and electro-optical devices. HEICO Corp. operates in two segments, the Flight Support group and the Electronic Technologies group. The Flight Support Group consists of HEICO Aerospace Holdings Corp. and HEICO Flight Support Corp., and their collective subsidiaries. The Electronic Technologies Group consists of HEICO Electronic Technologies Corp. and its subsidiaries. It designs, manufactures and sells various types of electronic, microwave and electro-optical products....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-05-15 12:32:00 Wednesday ET

The May administration needs to seek a fresh fallback option for Halloween Brexit. After the House of Commons rejects Brexit proposals from the May administ

2025-07-26 09:26:00 Saturday ET

Nir Eyal and Ryan Hoover explain why keystone habits lead us to purchase products, goods, and services in our lives. The Hooked Model can help shine new lig

2019-09-15 14:35:00 Sunday ET

U.S. Treasury officially designates China a key currency manipulator in the broader context of Sino-American trade dispute resolution. The U.S. Treasury cla

2019-11-09 16:38:00 Saturday ET

Federal Reserve Chairman Jerome Powell indicates that the central bank would resume Treasury purchases to avoid turmoil in money markets. Powell indicates t

2025-10-13 12:32:00 Monday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2018-08-27 09:35:00 Monday ET

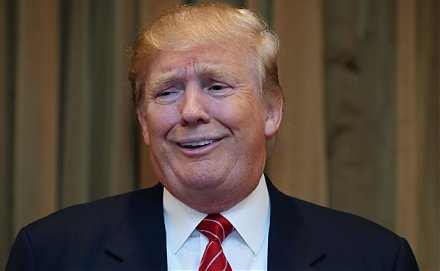

President Trump and his Republican senators and supporters praise the recent economic revival of most American counties. The Economist highlights a trifecta