Fair Isaac Corporation makes decisions smarter. The company's solutions and technologies for Enterprise Decision Management give businesses the power to automate more processes, and apply more intelligence to every customer interaction. Through increasing the precision, consistency and agility of their decisions, Fair Isaac clients worldwide increase sales, build customer value, cut fraud losses, manage credit risk, reduce operational costs, meet changing compliance demands and enter new markets more profitably. Fair Isaac powers hundreds of billions of decisions each year in financial services, insurance, telecommunications, retail, consumer branded goods, healthcare and the public sector....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-01-06 08:39:00 Sunday ET

President Trump signs an executive order to freeze federal employee pay in early-2019. Federal employees face furlough or work without pay due to the govern

2020-08-19 10:32:00 Wednesday ET

Corporate strategies, portfolio choices, and management memes add value and drive business process improvements over time. Andrew Campbell, Jo Whitehead,

2019-01-10 17:31:00 Thursday ET

The recent Bristol-Myers Squibb acquisition of American Celgene is the $90 billion biggest biotech deal in history. The resultant biopharma goliath would be

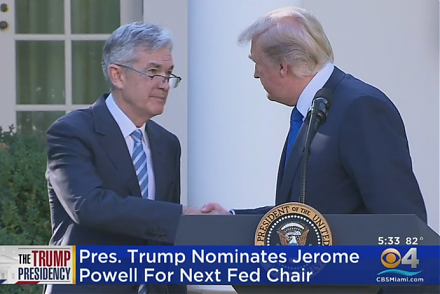

2017-10-03 18:39:00 Tuesday ET

President Trump has nominated Jerome Powell to run the Federal Reserve once Fed Chair Janet Yellen's current term expires in February 2018. Trump's

2020-08-01 07:28:00 Saturday ET

Technological advances, geopolitical risks, and pandemic outbreaks cannot shake investor confidence in the American dollar as the global reserve currency.

2022-05-25 09:31:00 Wednesday ET

Net stock issuance theory and practice Net equity issuance can be in the form of initial public offering (IPO) or seasoned equity offering (SEO). This l