CorVel Corporation is an independent national provider of innovative workers' compensation, auto, liability and health solutions for employers, insurance companies, third party administrators, and government agencies seeking to control costs and promote positive outcomes. The Company applies technology, intelligence, and a human touch throughout the risk management process so their clients can intervene early and often while being connected to the critical intelligence they need to proactively manage risk. The Company's services include automated medical fee auditing, national preferred provider network, early intervention, utilization review, medical case management, vocational rehabilitation services, telephonic case management and independent medical examinations. With a robust technology platform at its core, their connected solution is delivered by a national team of associates who are committed to helping clients design and administer programs that meet their organization's performance goals....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2024-03-26 09:30:00 Tuesday ET

Stock Synopsis: ESG value and momentum stock market portfolio strategies Since 2013, we have been delving into the broad topics of ESG (Environmental, So

2018-02-03 07:42:00 Saturday ET

Quant Quake 2.0 shakes investor confidence with rampant stock market fears and doubts during the recent Fed Chair transition from Janet Yellen to Jerome Pow

2020-09-17 12:28:00 Thursday ET

Many successful business organizations develop their distinctive capabilities and unique value propositions for strategic reasons. Paul Leinwand and Cesa

2018-11-13 12:30:00 Tuesday ET

President Trump promises a great trade deal with China as Americans mull over mid-term elections. President Trump wants to reach a trade accord with Chinese

2018-01-19 11:32:00 Friday ET

Most major economies grow with great synchronicity several years after the global financial crisis. These economies experience high stock market valuation,

2020-11-22 11:30:00 Sunday ET

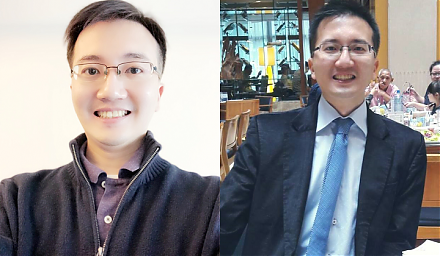

A brief biography of Andy Yeh Andy Yeh is responsible for ensuring maximum sustainable member growth within the Andy Yeh Alpha (AYA) fintech network pla