Chesapeake Utilities Corporation is a utility company engaged in natural gas distribution and transmission, propane distribution and marketing, advanced information services and other related businesses.Chesapeake's three natural gas distribution divisions serve residential, commercial and industrial customers in southern Delaware, Maryland's Eastern Shore and Florida. The Company's natural gas transmission subsidiary operates an interstate pipeline system that transports gas from various points in Pennsylvania to Delaware and Maryland distribution divisions....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-10-31 13:38:00 Thursday ET

AYA Analytica finbuzz podcast channel on YouTube October 2019 In this podcast, we discuss several topical issues as of October 2019: (1)

2018-06-21 10:42:00 Thursday ET

Harley Davidson plans to move its major production for European customers out of America due to European Union tariff retaliation. European Union retaliator

2017-05-31 06:36:00 Wednesday ET

The Federal Reserve rubber-stamps the positive conclusion that all of the 34 major banks pass their annual CCAR macro stress tests for the first time since

2018-12-03 10:40:00 Monday ET

Bank of England publishes its latest insights into the economic impact of Brexit on British real productivity, capital investment, and labor supply as of 20

2017-08-31 09:36:00 Thursday ET

The Trump administration has initiated a new investigation into China's abuse of American intellectual property under Section 301 of the Trade Act of 19

2018-09-13 19:38:00 Thursday ET

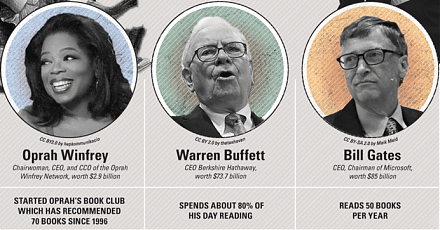

Bill Gates shares with Mark Zuckerberg his prior personal experiences of testifying on behalf of Microsoft before U.S. Congress. Both drop out of Harvard to