CME Group is the largest futures exchange in the world in terms of trading volume as well as notional value traded. CME Group offers a broad range of products covering major asset classes, based on interest rates, equity indexes, foreign exchange, energy, agricultural commodities and metals. Trades are executed through CME Group's electronic trading platforms, open outcry and privately negotiated transactions. CME Group also operates one of the world's leading central counterparty clearing providers through CME Clearing and CME Clearing Europe, which offer clearing and settlement services across asset classes for exchange-traded and over-the-counter derivatives. Apart from CME and CBOT, the company operates New York Mercantile Exchange, Inc. (NYMEX) and Commodity Exchange, Inc. (COMEX), CME Clearing Europe Limited (CMECE) and CME Europe Limited (CME Europe). The company reports the results of its operations as one operating segment mainly comprised of CME, CBOT, NYMEX and COMEX....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-02-28 20:44:00 Thursday ET

AYA Analytica finbuzz podcast channel on YouTube February 2019 In this podcast, we discuss several topical issues as of February 2019: (1) our proprieta

2018-01-23 06:38:00 Tuesday ET

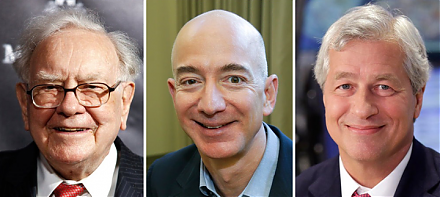

Amazon, Berkshire Hathaway, and JPMorgan Chase establish a new company to reduce U.S. employee health care costs in negotiations with drugmakers, doctors, a

2019-01-11 10:33:00 Friday ET

The Economist Intelligence Unit (EIU) continues to track major business risks in light of volatile stock markets, elections, and geopolitics. EIU monitors g

2018-08-03 07:33:00 Friday ET

President Trump escalates the current Sino-American trade war by imposing 25% tariffs on $200 billion Chinese imports. These tariffs encompass chemical prod

2019-06-27 10:39:00 Thursday ET

Berkeley tax economists Gabriel Zucman and Emmanuel Saez find fresh insights into wealth inequality in America. Their latest estimates show that the top 0.1

2020-01-01 13:39:00 Wednesday ET

President Trump approves a phase one trade agreement with China. This approval averts the introduction of new tariffs on Chinese imports. In return, China s