Chefs' Warehouse Holdings, LLC is a distributor of specialty food products in the United States. The Company is focused on serving the specific needs of chefs who own and/or operate restaurants, fine dining establishments, country clubs, hotels, caterers, culinary schools and specialty food stores. Its product portfolio includes artisan charcuterie, specialty cheeses, unique oils and vinegars, hormone-free protein, truffles, caviar, and chocolate. It also offers cooking oils, butter, eggs, milk, and flour. Chefs' Warehouse Holdings, LLC is based in Ridgefield, Connecticut....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-10-09 08:40:00 Tuesday ET

The International Monetary Fund (IMF) appoints Harvard professor Gita Gopinath as its chief economist. Gopinath follows her PhD advisor and trailblazer Kenn

2023-05-27 11:30:00 Saturday ET

Bank failure resolution and financial risk management: Silicon Valley Bank, Signature Bank, and First Republic Bank. What are the main root cau

2019-08-26 11:30:00 Monday ET

Partisanship matters more than the socioeconomic influence of the rich and elite interest groups. This new trend emerges from the recent empirical analysis

2019-07-05 09:32:00 Friday ET

Warwick macroeconomic expert Roger Farmer proposes paying for social welfare programs with no tax hikes. The U.S. government pension and Medicare liabilitie

2019-11-11 09:36:00 Monday ET

Apple upstream semiconductor chipmaker TSMC boosts capital expenditures to $15 billion with almost 10% revenue growth by December 2019. Due to high global d

2024-03-19 03:35:58 Tuesday ET

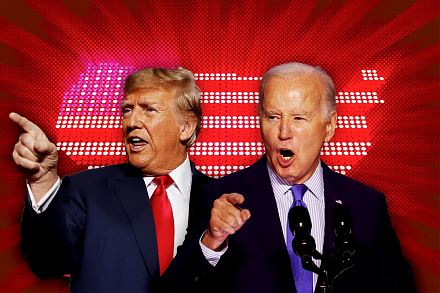

U.S. presidential election: a re-match between Biden and Trump in November 2024 We delve into the 5 major economic themes of the U.S. presidential electi