Crown Holdings is a global manufacturer of packaging products for consumer goods. Crown makes variety of steel and aluminum cans for food, beverage, household, and other consumer products and metal vacuum closures, steel crowns and caps. The company has 5 operating segments. Americas Beverage - The division manufactures aluminum beverage cans and ends, steel crowns, glass bottles and aluminum closures. European Beverage - The segment manufactures steel and aluminum beverage cans and ends. European Food - The segment manufactures steel and aluminum food cans, ends and metal vacuum closures. Crown Holdings completed the sale of its European Tinplate business to KPS Capital Partners. The business comprises the European Food segment and its European Aerosol and Promotional Packaging reporting unit. The business consists of manufacturing plants across Europe, Middle East and Africa. The Transit Packaging segment includes the company's global industrial and protective solutions and equipment and tools businesses....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2017-11-23 10:42:00 Thursday ET

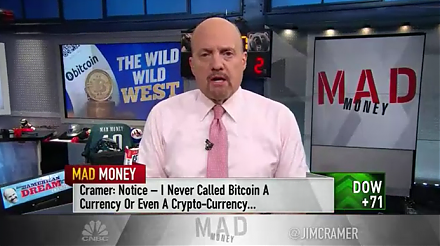

As the TV host of Mad Money, Jim Cramer provides 5 key reasons against the purchase and use of cryptocurrencies such as Bitcoin. First, no one knows the ano

2018-01-15 07:35:00 Monday ET

Treasury Secretary Steven Mnuchin welcomes a weak U.S. dollar amid pervasive fears of an open trade war between America and China. At the World Economic For

2018-03-11 08:27:00 Sunday ET

At 89 years old, Hong Kong billionaire Li Ka-Shing announces his retirement in March 2018. With a personal net worth of $35 billion, Li has an incredible ra

2026-07-01 11:29:00 Wednesday ET

In recent years, higher American economic growth has been impressive both by historical standards and in comparison to the rest of the world. American excep

2018-03-19 10:37:00 Monday ET

Uber's autonomous car causes the first known pedestrian fatality from a driverless vehicle and thus sets off the alarm bell for artificial intelligence.

2018-12-22 14:38:00 Saturday ET

Federal Reserve raises the interest rate to the target range of 2.25% to 2.5% as of December 2018. Fed Chair Jerome Powell highlights the dovish interest ra