CeriBell Inc. is a commercial-stage medical technology company. It focused on transforming the diagnosis and management of patients with serious neurological conditions. The company is an AI-powered, rapidly deployable point-of-care electroencephalography platform designed to address the unmet needs of patients in the acute care setting. CeriBell Inc. is based in Sunnyvale, Calif....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-12-21 11:39:00 Friday ET

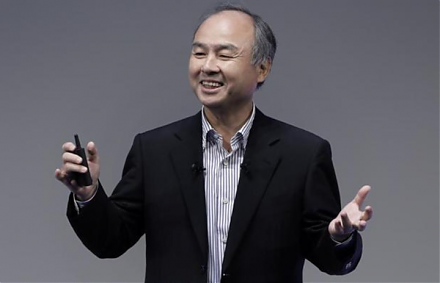

The Internet and telecom conglomerate SoftBank Group raises $23 billion in the biggest IPO in Japan. Going public is part of the major corporate move away f

2017-02-19 07:41:00 Sunday ET

In his recent book on personal finance, Tony Robbins recommends that each investor should rebalance his or her investment portfolio *only once a year* to in

2020-04-24 11:33:00 Friday ET

Disruptive innovations tend to contribute to business success in new blue-ocean markets after iterative continuous improvements. Clayton Christensen and

2017-12-01 06:30:00 Friday ET

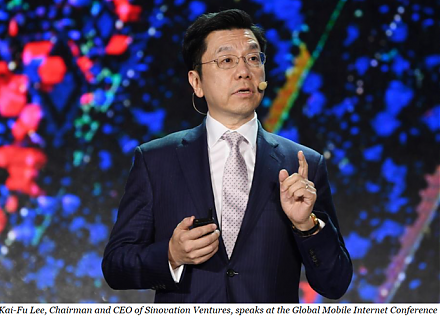

Dr Kai-Fu Lee praises China as the next epicenter of artificial intelligence, smart data analysis, and robotic automation. With prior IT careers at Apple, M

2018-03-03 11:37:00 Saturday ET

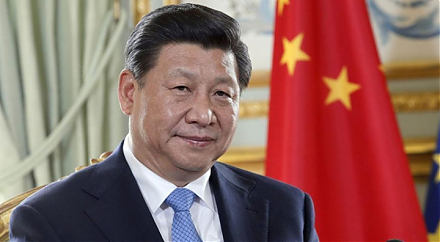

President Xi seeks Chinese congressional approval and constitutional amendment for abolishing his term limits of strongman rule with more favorable trade de

2018-07-15 11:35:00 Sunday ET

Facebook, Google, and Twitter attend a U.S. House testimony on whether these social media titans filter web content for political reasons. These network pla