Blackstone Inc. is an asset manager of alternative investments and a provider of financial advisory services globally. The company operates its businesses through four segments: Real Estate, Private Equity, Hedge Fund Solutions and Credit & Insurance. They invest across classes on behalf of their investors, including pension funds, insurance companies and individual investors....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-01-25 13:34:00 Friday ET

Netflix raises its prices by 13% to 18% for U.S. subscribers. The immediate stock market price soars 6.5% as a result of this upward price adjustment. The b

2018-09-13 19:38:00 Thursday ET

Bill Gates shares with Mark Zuckerberg his prior personal experiences of testifying on behalf of Microsoft before U.S. Congress. Both drop out of Harvard to

2018-03-25 08:39:00 Sunday ET

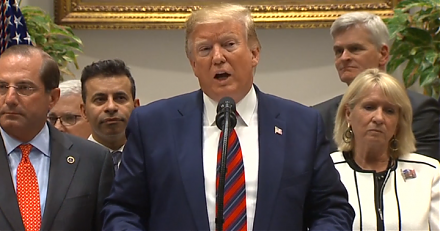

President Trump imposes punitive tariffs on $60 billion Chinese imports in a brand-new trade war as China hits back with retaliatory tariffs on $3 billion U

2019-07-17 12:37:00 Wednesday ET

Gold prices surge above $1400 per ounce amid global trade tension and economic policy uncertainty. Both European Central Bank and Bank of Japan may consider

2025-05-21 04:27:10 Wednesday ET

Carol Dweck describes, discusses, and delves into the scientific reasons why the growth mindset often helps motivate individuals, teams, and managers to acc

2019-05-11 10:28:00 Saturday ET

The Trump administration still expects to reach a Sino-U.S. trade agreement with a better mechanism for intellectual property protection and enforcement. Pr