Anheuser-Busch InBev is a global brewing company with more than 500 iconic brands. Anheuser-Busch InBev is one of the biggest brewing companies (by volume), also ranking among the top five consumer product firms. Following the acquisition of SABMiller in October 2016, the company holds the top spot in the beer industry, controlling about one-third of the global beer market .The company's diverse portfolio includes global brands like Budweiser, Corona and Stella Artois; multi-country brands like Beck's, Hoegaarden, Leffe and Michelob Ultra; and local names like Aguila, Antarctica, Bud Light, Brahma, Cass, Castle, Castle Lite, Cristal, Harbin, Jupiler, Modelo Especial, Quilmes, Victoria, Sedrin, and Skol....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2025-09-24 09:49:53 Wednesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2018-05-09 08:31:00 Wednesday ET

CBS and its special committee of independent directors have decided to sue the Redstone controlling shareholders because these directors might have breached

2019-05-19 19:31:00 Sunday ET

MIT professor and co-author Daron Acemoglu suggests that economic prosperity comes from high-wage job creation. Progressive tax redistribution cannot achiev

2019-07-09 15:14:00 Tuesday ET

The Chinese new star board launches for tech firms to list at home. The Nasdaq-equivalent new star board serves as a key avenue for Chinese tech companies t

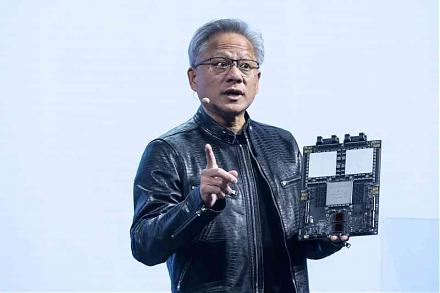

2023-05-27 11:30:00 Saturday ET

Bank failure resolution and financial risk management: Silicon Valley Bank, Signature Bank, and First Republic Bank. What are the main root cau

2025-09-21 12:32:00 Sunday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund