Boston Scientific Corporation manufactures medical devices and products used in various interventional medical specialties worldwide. The company has adopted the organic as well as inorganic routes for success. Boston Scientific currently has 3 global reportable segments - Cardiovascular, Rhythm and Neuro and MedSurg. While Cardiovascular includes Interventional Cardiology and Peripheral Interventions, Rhythm and Neuro comprises Cardiac Rhythm Management, Electrophysiology and Neuromodulation. The MedSurg group comprises 2 sub segments, viz. Endoscopy, Urology and Pelvic Health. Boston Scientific markets a broad portfolio of internally-developed and self-manufactured drug eluting stents including the Promus PREMIER, Promus Element and Promus Element Plus everolimus-eluting stents. Within the CRM segment, the company deals with implantable devices that monitor the heart and deliver electricity to treat cardiac abnormalities....

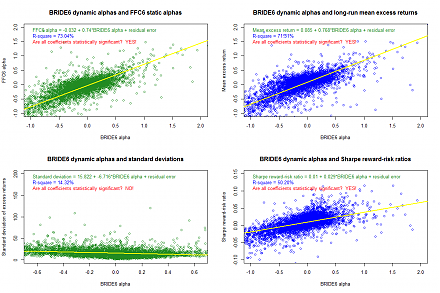

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-01-09 10:31:00 Monday ET

Response to USPTO fintech patent protection As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S. utility patent

2019-03-15 13:36:00 Friday ET

CNBC stock host Jim Cramer recommends both Caterpillar and Home Depot as the U.S. bull market is likely to continue in light of the recent Fed Chair comment

2019-06-17 11:25:00 Monday ET

To secure better economic arrangements with European Union, Jeremy Corbyn encourages Labour legislators to back a second referendum on Brexit. In recent tim

2019-01-09 07:33:00 Wednesday ET

Apple revises down its global sales revenue estimate to $83 billion due to subpar smartphone sales in China. Apple CEO Tim Cook points out the fact that he

2019-05-30 16:44:00 Thursday ET

AYA Analytica finbuzz podcast channel on YouTube May 2019 In this podcast, we discuss several topical issues as of May 2019: (1) Our proprietary alp

2023-12-05 09:25:00 Tuesday ET

Better corporate ownership governance through worldwide convergence toward Berle-Means stock ownership dispersion Abstract We design a model