Blue Ridge Bankshares Inc. is a multi-state bank holding company. It is the parent company of Blue Ridge Bank which provides financial services as well as commercial banking services throughout Virginia and North Carolina. Blue Ridge Bankshares Inc. is based in CHARLOTTESVILLE, Va....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-01-04 07:36:00 Thursday ET

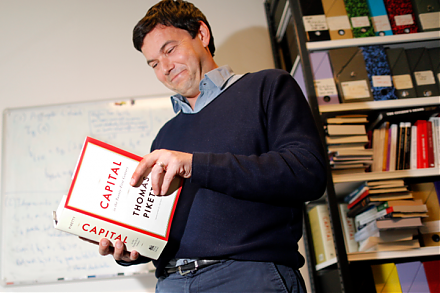

The world now faces an economic inequality crisis with few policy options. Some recent U.S. Federal Reserve data suggest that both income and wealth inequal

2018-03-29 14:28:00 Thursday ET

Share prices tumble for technology stocks due to Trump's criticism of Amazon's tax avoidance, Facebook user data breach of trust, and Tesla autopilo

2020-03-05 08:28:00 Thursday ET

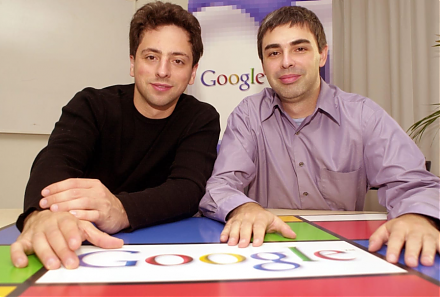

The Stanford computer science overlords Larry Page and Sergey Brin design and develop Google as an Internet search company. Janet Lowe (2009) Google s

2018-06-01 07:30:00 Friday ET

The U.S. federal government debt has risen from less than 40% of total GDP about a decade ago to 78% as of May 2018. The Congressional Budget Office predict

2019-06-15 10:28:00 Saturday ET

The Sino-American trade war may slash global GDP by $600 billion. If the Trump administration imposes tariffs on all the Chinese imports and China retaliate

2019-06-05 10:34:00 Wednesday ET

Fed Chair Jay Powell suggests that the recent surge in U.S. business debt poses moderate risks to the economy. Many corporate treasuries now carry about 40%