Buckeye Partners, L.P. (Buckeye), incorporated on July 11, 1986, owns and operates a network of integrated assets providing midstream logistic solutions, primarily consisting of the transportation, storage, processing and marketing of liquid petroleum products. The Company's segments include Domestic Pipelines & Terminals, Global Marine Terminals and Merchant Services. Buckeye GP LLC (Buckeye GP) is the Company's general partner. The Company is an independent terminaling and storage operator in the United States in terms of capacity available for service. As of December 31, 2016, the Company's terminal network included more than 120 liquid petroleum products terminals with aggregate storage capacity of over 115 million barrels across its portfolio of pipelines, inland terminals and marine terminals located primarily in the East Coast, Midwest and Gulf Coast regions of the United States and in the Caribbean. ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-11-07 11:31:00 Tuesday ET

Joel Mokyr suggests that economic growth arises from a change in cultural beliefs toward technological progress. Joel Mokyr (2018) A culture

2017-01-27 17:19:00 Friday ET

Tony Robbins explains in his latest book on personal finance that *patience* is the top secret to successful stock investment. The stock market embeds an

2018-12-19 17:41:00 Wednesday ET

Tencent Music Entertainment debuts its IPO on NYSE to strike a chord with stock market investors. Tencent Music goes public and marks the biggest IPO by a m

2020-11-10 07:25:00 Tuesday ET

The McKinsey edge reflects the collective wisdom of key success principles in business management consultancy. Shu Hattori (2015) The McKins

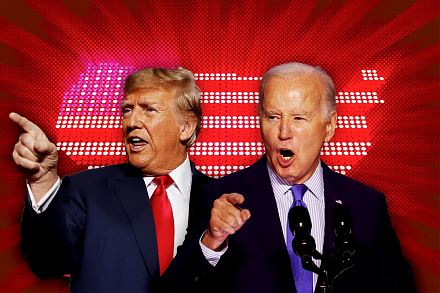

2024-03-19 03:35:58 Tuesday ET

U.S. presidential election: a re-match between Biden and Trump in November 2024 We delve into the 5 major economic themes of the U.S. presidential electi

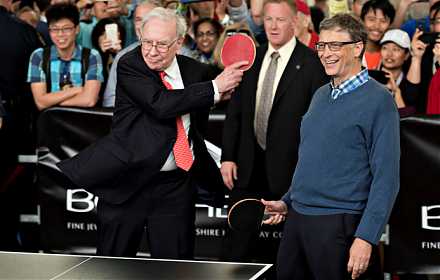

2017-11-13 07:42:00 Monday ET

Top 2 wealthiest men Bill Gates and Warren Buffett shared their best business decisions in a 1998 panel discussion with students at the University of Washin