Buckeye Partners, L.P. (Buckeye), incorporated on July 11, 1986, owns and operates a network of integrated assets providing midstream logistic solutions, primarily consisting of the transportation, storage, processing and marketing of liquid petroleum products. The Company's segments include Domestic Pipelines & Terminals, Global Marine Terminals and Merchant Services. Buckeye GP LLC (Buckeye GP) is the Company's general partner. The Company is an independent terminaling and storage operator in the United States in terms of capacity available for service. As of December 31, 2016, the Company's terminal network included more than 120 liquid petroleum products terminals with aggregate storage capacity of over 115 million barrels across its portfolio of pipelines, inland terminals and marine terminals located primarily in the East Coast, Midwest and Gulf Coast regions of the United States and in the Caribbean. ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-04-02 07:33:00 Monday ET

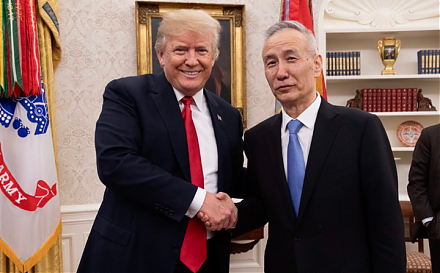

China President Xi JinPing tries to ease trade tension between America and China in his presidential address at the annual Boao forum. In his vulnerable att

2026-07-01 11:29:00 Wednesday ET

In recent years, higher American economic growth has been impressive both by historical standards and in comparison to the rest of the world. American excep

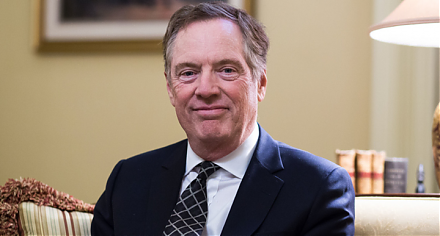

2019-03-17 14:35:00 Sunday ET

U.S. trade rep Robert Lighthizer proposes America to require regular touchpoints to ensure Sino-U.S. trade deal enforcement. America has to maintain the thr

2018-10-17 12:33:00 Wednesday ET

The Trump administration blames China for egregious currency misalignment, but this criticism cannot confirm *currency manipulation* on the part of the Chin

2018-03-19 10:37:00 Monday ET

Uber's autonomous car causes the first known pedestrian fatality from a driverless vehicle and thus sets off the alarm bell for artificial intelligence.

2020-09-15 08:38:00 Tuesday ET

Macro eigenvalue volatility helps predict some recent episodes of high economic policy uncertainty, recession risk, or rare events such as the recent rampan