BG Staffing, Inc. provides temporary staffing services in the United States. It operates through three segments: Real Estate, Professional, and Light Industrial. The Real Estate segment offers office and maintenance personnel to the various apartment communities and commercial buildings. The Professional segment provides skilled IT professionals with expertise in SAP, Workday, Olik View, Hyperion, Oracle, project management, and other IT staffing skills, as well as finance, accounting, legal, and related support personnel. The Light Industrial segment offers temporary workers for various skilled and unskilled positions primarily to manufacturing, distribution, logistics, and call center customers. The company was formerly known as LTN Staffing, LLC and changed its name to BG Staffing, Inc. in November 2013. BG Staffing, Inc. is headquartered in Plano, Texas....

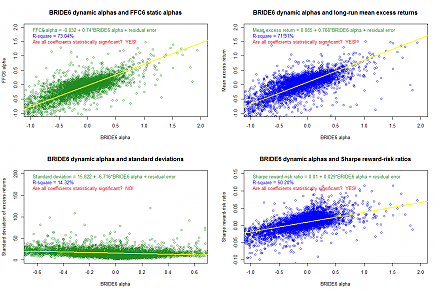

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-01-03 09:34:00 Tuesday ET

USPTO fintech patent protection and accreditation As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved

2017-06-21 05:36:00 Wednesday ET

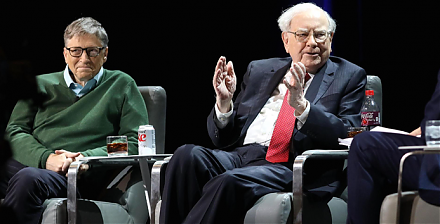

In his latest Berkshire Hathaway annual letter to shareholders, Warren Buffett points out that many people misunderstand his stock investment method in seve

2019-04-05 08:25:00 Friday ET

Warren Buffett places his $58 billion stock bets on Apple, American Express, and Goldman Sachs. Berkshire Hathaway owns $18 billion equity stakes in America

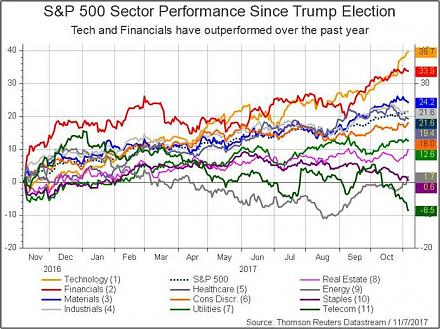

2017-10-09 09:34:00 Monday ET

The current Trump stock market rally has been impressive from November 2016 to October 2017. S&P 500 has risen by 21.1% since the 2016 presidential elec

2017-09-19 05:34:00 Tuesday ET

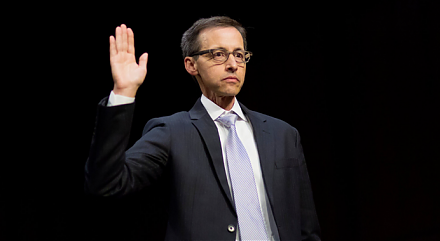

Facebook, Twitter, and Google executives head before the Senate Judiciary Committee to explain the scope of Russian interference in the U.S. presidential el

2018-04-29 13:44:00 Sunday ET

College education offers a hefty 8.8% pay premium for each marginal increase in the number of years of intellectual attainment in contrast to the 5.6%-6% lo