Business First Bancshares Inc. provides commercial and personal banking services to small to midsize businesses. Its services includes checking and savings accounts, certificates of deposit, individual retirement accounts, consumer loans, commercial and non-profit checking, commercial interest checking, business sweep investment, essential business checking, business value checking accounts, business loans, cash management and merchant processing and other services. The company operates primarily in Baton Rouge, Brusly, Covington, Denham Springs, Erwinville, Gonzales, Houma, Lafayette, New Orleans, Shreveport, Port Allen, Zachary and Lake Charles, Louisiana as well as Dallas, Texas. Business First Bancshares Inc. is based in Clayton, United States....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-10-14 10:32:00 Saturday ET

Jonathan Baker frames the current debate over antitrust merger review and enforcement in America. Jonathan Baker (2019) The antitrust paradi

2018-07-21 13:35:00 Saturday ET

President Trump supports a bipartisan bill or the Foreign Investment Risk Review Modernization Act (FIRRMA), which effectively broadens the jurisdiction of

2017-10-03 18:39:00 Tuesday ET

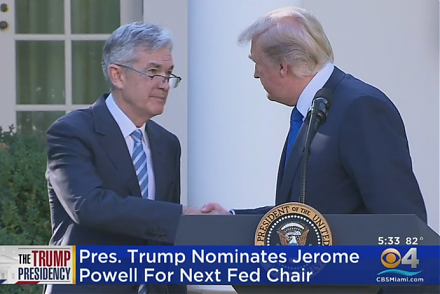

President Trump has nominated Jerome Powell to run the Federal Reserve once Fed Chair Janet Yellen's current term expires in February 2018. Trump's

2019-08-12 07:30:00 Monday ET

Facebook reaches a $5 billion settlement with the Federal Trade Commission over Cambridge Analytica user privacy violations. The Federal Trade Commission (F

2022-02-22 09:30:00 Tuesday ET

The global asset management industry is central to modern capitalism. Mutual funds, pension funds, sovereign wealth funds, endowment trusts, and asset ma

2019-07-23 09:22:00 Tuesday ET

Harvard economic platform researcher Dipayan Ghosh proposes some alternative solutions to breaking up tech titans such as Facebook, Google, Apple, and Amazo