Belmond Ltd. (Belmond), incorporated on October 16, 1987, is a hotel company and adventure travel operator. As of December 31, 2016, Belmond owned, partially-owned and/or operated 45 properties, consisting of 34 individual deluxe hotels, 29 of which are owned (including nine under long-term lease), five European tourist trains, two cruise ships in Myanmar (one of which is under long-term charter), one French canal cruise business consisting of five small canal boats, and one stand-alone restaurant in the United States. It operates through six segments: owned hotels in Europe, owned hotels in North America (including one stand-alone restaurant), owned hotels in Rest of world, owned trains and cruises, part-owned/managed hotels and part-owned/managed trains. As of December 31, 2016, Belmond's around the world portfolio of hotels in operation consisted of 3,272 individual guest rooms and multiple-room suites (keys). ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-09-23 12:25:00 Monday ET

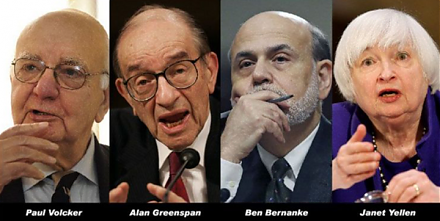

Volcker, Greenspan, Bernanke, and Yellen contribute to a Wall Street Journal op-ed on monetary policy independence. These former Federal Reserve chiefs unit

2018-05-19 09:29:00 Saturday ET

Treasury Secretary Steve Mnuchin indicates that the Trump team puts the trade war with China on hold. The interim suspension of U.S. tariffs should offer in

2019-02-17 14:40:00 Sunday ET

U.S. economic inequality increases to pre-Great-Depression levels. U.C. Berkeley economics professor Gabriel Zucman empirically finds that the top 0.1% rich

2018-01-17 05:30:00 Wednesday ET

European Union antitrust regulators impose a fine on Qualcomm for advancing its key exclusive microchip deal with Apple to block out rivals such as Intel an

2023-04-14 13:32:00 Friday ET

Calomiris and Haber delve into the comparative analysis of bank crises and politics in America, Britain, Canada, Mexico, and Brazil. Charles Calomiris an

2019-06-19 09:27:00 Wednesday ET

San Francisco Fed CEO Mary Daly suggests that trade escalation is not the only risk in the global economy. Due to the current Sino-U.S. trade tension, the g