Berenson Acquisition Corp. I is a blank check company. It intends to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or related business combination with one or more businesses. Berenson Acquisition Corp. I is based in New York....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-08-01 11:43:00 Wednesday ET

Apple becomes the first company to hit $1 trillion stock market valuation. The tech titan sells about the same number of smart phones or 41 million iPhones

2018-10-17 12:33:00 Wednesday ET

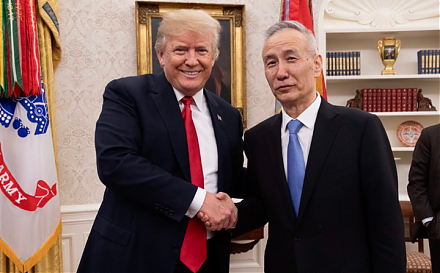

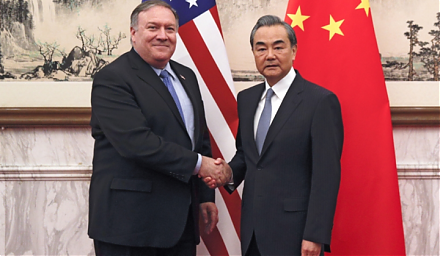

The Trump administration blames China for egregious currency misalignment, but this criticism cannot confirm *currency manipulation* on the part of the Chin

2019-10-01 11:33:00 Tuesday ET

The Trump administration postpones increasing 25% to 30% tariffs on $250 billion Chinese imports after China extends an olive branch to de-escalate Sino-Ame

2019-04-03 11:35:00 Wednesday ET

A Florida fintech group Fidelity Information Services initiates the largest $43 billion acquisition of the e-commerce payments processor Worldpay. Fidelity

2020-11-03 08:30:00 Tuesday ET

Agile lean enterprises break down organizational silos to promote smart collaboration for better profitability and customer loyalty. Heidi Gardner (2017

2026-01-19 10:30:00 Monday ET

Andy Yeh Alpha (AYA) fintech network platform: major milestones, key product features, and online social media services Introduction