Avalon Holdings Corporation provides waste management services to industrial, commercial, municipal and governmental customers in selected northeastern and midwestern U.S. markets. The company's waste management services include hazardous and non-hazardous waste brokerage and management, and captive landfill management services. This segment offers its services to industrial, commercial, municipal, and governmental customers primarily in selected northeastern and midwestern markets. Avalon Holdings Corporation also owns the Avalon Golf and Country Club, which operates golf courses and related facilities. The company is headquartered in Warren, Ohio....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-04-07 13:39:00 Sunday ET

CNBC news anchor Becky Quick interviews Warren Buffett in early-2019. Buffett explains the fact that book value fluctuations are a metric that has lost rele

2017-09-25 09:42:00 Monday ET

President Trump has allowed most JFK files to be released to the general public. This batch of documents reveals many details of the assassination of Presid

2023-04-14 13:32:00 Friday ET

Calomiris and Haber delve into the comparative analysis of bank crises and politics in America, Britain, Canada, Mexico, and Brazil. Charles Calomiris an

2022-04-25 10:34:00 Monday ET

Corporate ownership governance theory and practice The genesis of modern corporate governance and ownership studies traces back to the seminal work

2019-04-23 19:45:00 Tuesday ET

Income and wealth concentration follows the ebbs and flows of the business cycle in America. Economic inequality not only grows among people, but it also gr

2019-10-01 11:33:00 Tuesday ET

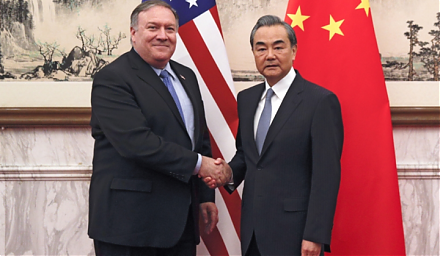

The Trump administration postpones increasing 25% to 30% tariffs on $250 billion Chinese imports after China extends an olive branch to de-escalate Sino-Ame