Avedro, Inc., an ophthalmic pharmaceutical and medical device company, develops and commercializes products to treat ophthalmic disorders and conditions, primarily associated with corneal weakness. The company's Avedro Corneal Remodeling platform comprises KXL and Mosaic systems, which deliver ultraviolet A or UVA light, and a suite of single-use riboflavin drug formulations. Its Avedro Corneal Remodeling platform treats corneal ectatic disorders and corrects refractive conditions; and KXL system in combination with Photrexa drug formulations used for the treatment of progressive keratoconus and corneal ectasia following refractive surgery. Avedro sells its products primarily to ophthalmologists, hospitals, and ambulatory surgery centers through a direct sales force in the United States, as well as through medical device distributors internationally. The company was formerly known as ThermalVision, Inc. and changed its name to Avedro, Inc. in October 2005. Avedro, Inc. was incorporated in 2002 and is headquartered in Waltham, Massachusetts....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-02-25 12:41:00 Monday ET

Chicago financial economist Raghuram Rajan views communities as the third pillar of liberal democracy in addition to open markets and states. Rajan suggests

2019-05-17 15:24:00 Friday ET

A Harvard MBA graduate Camilo Maldonado shares several life lessons and wise insights into personal finance. People can leverage stock market investments an

2019-10-19 16:35:00 Saturday ET

European economic integration seems to have gone backwards primarily due to the recent Brexit movement. Brexit, key European sovereign debt, and French and

2017-03-27 06:33:00 Monday ET

Goldman Sachs chief economist Jan Hatzius says the Federal Reserve's QE exit strategy makes sense ahead of Fed Chair Janet Yellen's stepdown in 2018

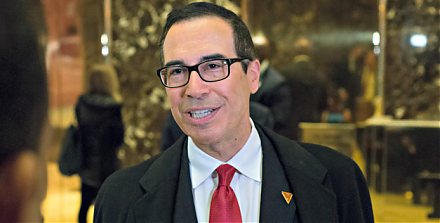

2017-05-25 08:35:00 Thursday ET

Treasury Secretary Steve Mnuchin has released a 147-page report on financial deregulation under the Trump administration. This financial deregulation seeks

2019-06-23 08:30:00 Sunday ET

The financial crisis of 2008-2009 affects many millennials as they bear the primary costs of college tuition, residential demand, health care, and childcare