Grupo Aval Acciones y Valores S.A. is a financial services group. It provides a comprehensive range of financial services and products ranging from traditional banking services, such as making loans and taking deposits, to pension and severance fund management. The company also provides general purpose loans, foreign exchange services, documentation services, guarantees, auto financing, payroll loans, and credit cards, as well as various deposit and basic treasury products. It provides fiduciary services; merchandise storage and deposit, customs agency, cargo management, and merchandise distribution; brokerage services, fund management, portfolio management, securities management, and capital markets consulting services; and investment banking, treasury, and private banking services. Grupo Aval Acciones Y Valores S.A. is based in Bogot', Colombia....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-12-07 11:30:00 Saturday ET

China turns on its 5G telecom networks in the hot pursuit of global tech supremacy. China Telecom, China Unicom, and China Mobile disclose 5G fees of $18-$2

2019-09-23 12:25:00 Monday ET

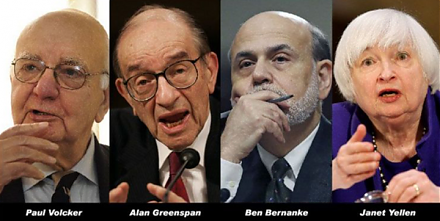

Volcker, Greenspan, Bernanke, and Yellen contribute to a Wall Street Journal op-ed on monetary policy independence. These former Federal Reserve chiefs unit

2019-08-28 14:46:00 Wednesday ET

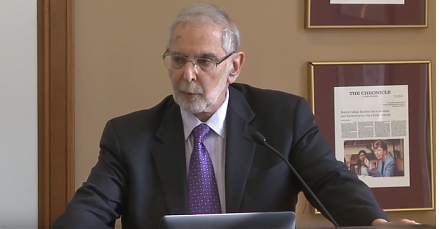

Santa-Barbara political economy professor Benjamin Cohen proposes new fiscal stimulus to complement the current low-interest-rate monetary policy. Cohen fin

2019-08-22 11:35:00 Thursday ET

Fundamental factors often reflect macroeconomic innovations and so help inform better stock investment decisions. Nobel Laureate Eugene Fama and his long-ti

2019-12-10 09:30:00 Tuesday ET

Federal Reserve institutes the third interest rate cut with a rare pause signal. The Federal Open Market Committee (FOMC) reduces the benchmark interest rat

2018-06-04 08:38:00 Monday ET

Microsoft acquires GitHub, a software development platform that has been widely shared-and-used by more than 28 million programmers worldwide. GitHub's