Atotech Limited is a specialty chemical technology as well as electroplating solution company. It delivers chemistry, equipment, services and software for technology applications through an integrated systems and solutions approach. The company serves smartphones and other consumer electronics, communications infrastructure, and computing, as well as industrial and consumer applications such as automotive, heavy machinery, and household appliances. Atotech Limited is headquartered in Berlin, Germany....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-03-09 08:33:00 Friday ET

David Solomon succeeds Lloyd Blankfein as the new CEO of Goldman Sachs. Unlike his predecessors Lloyd Blankfein and Gary Cohn, Solomon has been an investmen

2018-10-17 12:33:00 Wednesday ET

The Trump administration blames China for egregious currency misalignment, but this criticism cannot confirm *currency manipulation* on the part of the Chin

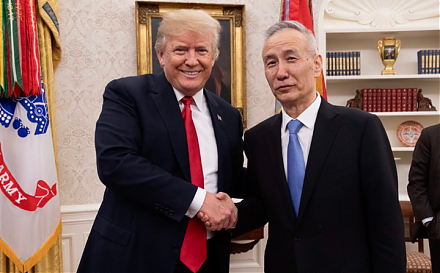

2020-01-15 08:31:00 Wednesday ET

Anti-competitive corporate practices may stifle U.S. innovation. In recent decades, wage growth, economic output, and productivity tend to stagnate as U.S.

2018-11-03 11:36:00 Saturday ET

Apple adds fresh features to its new iPad Pro and MacBook Air in addition to its prior suite of iPhone XS, iPhone XS Max, and iPhone XR back in September 20

2019-04-05 08:25:00 Friday ET

Warren Buffett places his $58 billion stock bets on Apple, American Express, and Goldman Sachs. Berkshire Hathaway owns $18 billion equity stakes in America

2018-05-25 07:30:00 Friday ET

President Trump introduces $50 billion tariffs on Chinese products and new limits on Chinese high-tech investments in America. This new round of tariffs