Altisource Portfolio Solutions S.A., together with its subsidiaries, is engaged in provision of real estate mortgage portfolio management and related technology products, as well as asset recovery and customer relationship management services. The Company has three segments: Mortgage Services, Financial Services and Technology Products. Mortgage Services provides valuation, real estate sales, default processing services, property inspection and preservation services, homeowner outreach, closing and title services and knowledge process outsourcing services. Financial Services comprises the Company's asset recovery management and customer relationship management offerings to the financial services, consumer products, telecommunications and utilities industries. Technology Products is engaged in the design, development and delivery of technology products and services to the mortgage industry....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-11-14 08:24:00 Tuesday ET

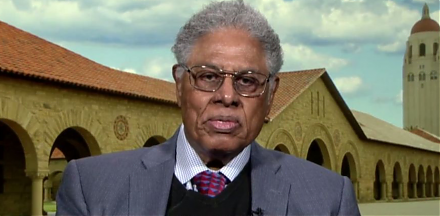

Thomas Sowell argues that some economic reforms inadvertently exacerbate economic disparities. Thomas Sowell (2019) Discrimination and econo

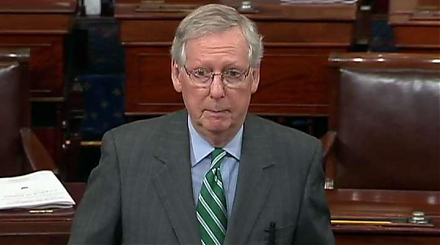

2018-03-15 07:41:00 Thursday ET

The Trump administration's $1.5 trillion hefty tax cuts and $1 trillion infrastructure expenditures may speed up the Federal Reserve interest rate hike

2020-05-21 11:30:00 Thursday ET

Most blue-ocean strategists shift fundamental focus from current competitors to alternative non-customers with new market space. W. Chan Kim and Renee Ma

2020-06-17 09:23:00 Wednesday ET

Successful founders focus on their continuous growth, passion, perseverance, and the collective wisdom of most team members. William Ferguson (2013) &

2019-08-10 21:44:00 Saturday ET

McKinsey Global Institute analyzes 315 U.S. cities and 3,000 counties in terms of how tech automation affects their workers in the next 5 to 10 years. This

2019-08-20 07:33:00 Tuesday ET

The recent British pound depreciation is a big Brexit barometer. Britain appoints former London mayor and Foreign Secretary Boris Johnson as the prime minis