Apergy Corporation, together with its subsidiaries, provides engineered equipment and technologies that help companies drill for and produce oil and gas worldwide. The company operates through two segments, Production & Automation Technologies and Drilling Technologies. The Production & Automation Technologies segment offers artificial lift equipment and solutions, including rod pumping systems, electric submersible pump systems, progressive cavity pumps, and drive systems and plunger lifts, as well as automation and digital equipment that consist of software and industrial Internet of Things solutions for downhole monitoring, wellsite productivity enhancement, and asset integrity management. It offers its products under the Harbison-Fischer, Norris, Alberta Oil Tool, Oil Lift Technology, PCS Ferguson, Pro-Rod, Upco, ESP, Norriseal-Wellmark, Quartzdyne, Spirit, Theta, Timberline, and Windrock brands. The Drilling Technologies segment designs, manufactures, and markets polycrystalline diamond cutters and bearings for use in oil and gas drill bits under the US Synthetic brand. It serves national, large integrated, and independent oil and gas companies; oilfield equipment and service provider; and pipeline companies. The company was formerly known as Wellsite Corporation and changed its name to Apergy Corporation in February 2018. Apergy Corporation was incorporated in 2017 and is headquartered in The Woodlands, Texas....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2017-10-15 07:38:00 Sunday ET

Ivanka Trump and Treasury Secretary Steven Mnuchin both press the case for GOP tax legislation as economic relief for the middle-class without substantial t

2017-12-19 09:39:00 Tuesday ET

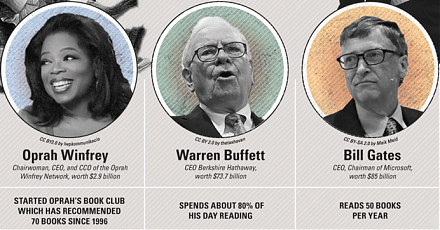

From Oprah Winfrey to Bill Gates, this infographic visualization summarizes the key habits and investment styles of highly successful entrepreneurs:

2018-06-01 07:30:00 Friday ET

The U.S. federal government debt has risen from less than 40% of total GDP about a decade ago to 78% as of May 2018. The Congressional Budget Office predict

2018-01-29 07:38:00 Monday ET

President Donald Trump delivers his first state-of-the-union address. Several key highlights touch on economic issues from fiscal stimulus and trade protect

2018-11-25 12:37:00 Sunday ET

The Chinese administration delivers a written response to U.S. demands for trade reforms. This strategic move helps trigger more formal negotiations between

2025-04-30 08:27:00 Wednesday ET

The multiple layers of the world cloud Internet help expand what can be made digitally viable from electric vehicles (EV) and virtual reality (VR) headsets