AmeriGas Partners, L.P., incorporated on November 2, 1994, is a holding company. The Company is a retail propane distributor in the United States. It serves approximately two million residential, commercial, industrial, agricultural, wholesale and motor fuel customers in all 50 states from approximately 2,000 propane distribution locations. It operates through the segment that engages in the distribution of propane and related equipment and supplies. The Company conducts its business through its subsidiary, AmeriGas Propane, L.P. (AmeriGas OLP or Operating Partnership). AmeriGas Propane, Inc. is the Company's general partner (the General Partner) and is responsible for managing its operations. ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2025-10-09 11:30:00 Thursday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2018-01-23 06:38:00 Tuesday ET

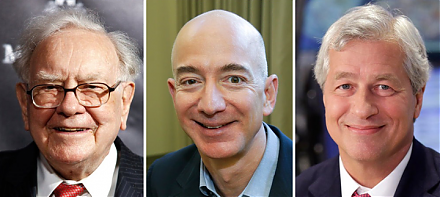

Amazon, Berkshire Hathaway, and JPMorgan Chase establish a new company to reduce U.S. employee health care costs in negotiations with drugmakers, doctors, a

2018-03-03 11:37:00 Saturday ET

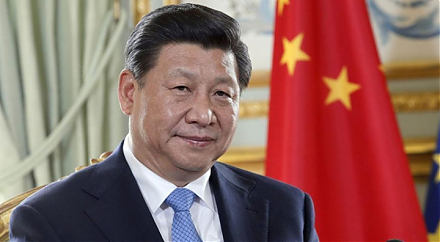

President Xi seeks Chinese congressional approval and constitutional amendment for abolishing his term limits of strongman rule with more favorable trade de

2019-10-11 13:40:00 Friday ET

Apple CEO Tim Cook maintains a frugal low-key lifestyle. With $625 million public wealth, Cook leads the $1 trillion tech titan Apple in the post-Jobs era.

2018-12-17 08:43:00 Monday ET

Apple files an appeal to overturn the recent iPhone sales ban in China due to its patent infringement of Qualcomm proprietary technology. This recent ban of

2018-06-10 19:41:00 Sunday ET

Apple enters a multi-year content partnership with Oprah Winfrey to provide new original online video and TV programs in direct competition with Netflix, Am