Ameriprise Financial, Inc. has been operating independently of American Express Company. Ameriprise has 4 business segments. The Advice & Wealth Management segment provides financial planning and advice, as well as full service brokerage and banking services, primarily to retail clients through the company's affiliated financial advisors. The Asset Management segment provides investment advice and investment products to retail, high net worth and institutional clients on a global scale through Columbia Management and Threadneedle Asset Management Holdings S'rl. The Retirement & Protection Solutions segment includes Retirement Solutions (Variable Annuities and Payout Annuities) and Protection Solutions (Life and Disability Insurance). Ameriprise realizes net investment income on corporate level assets from its Corporate & Other segment. This includes excess capital held in RiverSource Life and other unallocated equity and revenues from various investments, as well as unallocated corporate expenses....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-06-09 16:40:00 Saturday ET

The Trump administration introduces new tariffs on $50 billion Chinese goods amid the persistent bilateral trade dispute. The tariffs effectively boost cost

2019-09-11 09:31:00 Wednesday ET

Central banks in India, Thailand, and New Zealand lower their interest rates in a defensive response to the Federal Reserve recent rate cut. The central ban

2018-08-03 07:33:00 Friday ET

President Trump escalates the current Sino-American trade war by imposing 25% tariffs on $200 billion Chinese imports. These tariffs encompass chemical prod

2018-12-07 11:35:00 Friday ET

Fed Chair Jerome Powell hints slower interest rate increases because the current rate is just below the neutral threshold. NYSE and NASDAQ share prices rebo

2018-02-07 06:38:00 Wednesday ET

The new Fed chairman Jerome Powell faces a new challenge in the form of both core CPI and CPI inflation rate hikes toward 1.8%-2.1% year-over-year with stro

2023-04-21 12:39:00 Friday ET

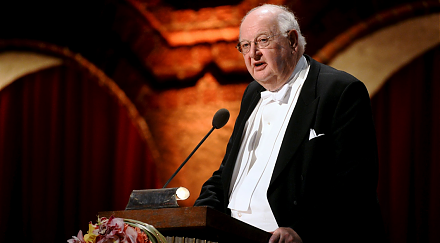

Angus Deaton analyzes the correlation between health and wealth in light of the economic origins of inequality worldwide. Angus Deaton (2015)