Ameriprise Financial, Inc. has been operating independently of American Express Company. Ameriprise has 4 business segments. The Advice & Wealth Management segment provides financial planning and advice, as well as full service brokerage and banking services, primarily to retail clients through the company's affiliated financial advisors. The Asset Management segment provides investment advice and investment products to retail, high net worth and institutional clients on a global scale through Columbia Management and Threadneedle Asset Management Holdings S'rl. The Retirement & Protection Solutions segment includes Retirement Solutions (Variable Annuities and Payout Annuities) and Protection Solutions (Life and Disability Insurance). Ameriprise realizes net investment income on corporate level assets from its Corporate & Other segment. This includes excess capital held in RiverSource Life and other unallocated equity and revenues from various investments, as well as unallocated corporate expenses....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-10-15 09:33:00 Monday ET

Several pharmaceutical companies now switch their primary focus from generic prescription drugs to medical specialties such as cardiovascular medications an

2019-09-17 08:33:00 Tuesday ET

Global stock market investors foresee the harbinger of a major economic downturn. Many stock market investors become anxious due to negative term spreads an

2020-01-15 08:31:00 Wednesday ET

Anti-competitive corporate practices may stifle U.S. innovation. In recent decades, wage growth, economic output, and productivity tend to stagnate as U.S.

2018-06-25 12:43:00 Monday ET

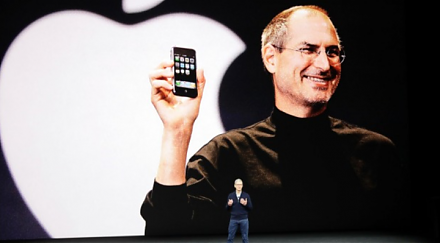

Apple and Samsung are the archrivals for the title of the world's top smart phone maker. The recent patent lawsuit settlement between Apple and Samsung

2018-08-21 11:40:00 Tuesday ET

President Trump criticizes his new Fed Chair Jerome Powell for accelerating the current interest rate hike with greenback strength. This criticism overshado

2019-01-17 10:41:00 Thursday ET

Sino-American trade talks make positive progress over 3 consecutive days as S&P 500 and global stock market indices post 3-day win streaks. Asian and Eu