Autoliv Inc., operating through two principal subsidiaries Autoliv AB and Autoliv ASP, is one of the leading manufacturers and suppliers of a wide range of products, which majorly includes passive safety systems. Its passive safety systems include modules and components for frontal-impact & side-impact airbag protection systems, seatbelts, steering wheels, inflator technologies, battery cable cutters, pedestrian protection systems and child seats. Autoliv engages in joint ventures to expand geographical expansion, develop and gain support to market its full product line to vehicle manufacturers. Its business is conducted in five key regions, which includes Europe, the Americas, China, Japan and the Rest of Asia.'Major customers of this automotive safety supplier include Mitsubishi Motors, Nissan, Renault, Ford, Volkswagen, Hyundai, Kia, Honda, Toyota, Daimler, General Motors, BMW and Stellantis. It has two reportable segments: Airbags & Associated Products'and Seatbelts & Associated Products....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-04-25 09:35:00 Thursday ET

Bridgewater hedge fund founder Ray Dalio suggests that the current state of U.S. capitalism poses an existential threat for many Americans. Dalio deems the

2019-09-15 14:35:00 Sunday ET

U.S. Treasury officially designates China a key currency manipulator in the broader context of Sino-American trade dispute resolution. The U.S. Treasury cla

2019-03-13 12:35:00 Wednesday ET

Uber seeks an IPO in close competition with its rideshare rival Lyft and other tech firms such as Slack, Pinterest, and Palantir. Uber expects to complete o

2023-07-14 10:32:00 Friday ET

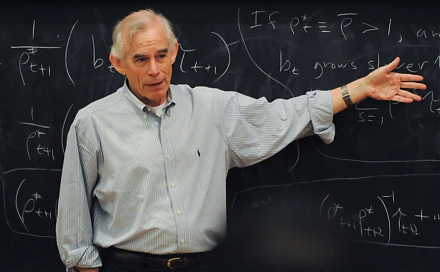

Ray Fair applies his macroeconometric model to study the central features of the U.S. macroeconomy such as price stability and full employment in the dual m

2023-06-14 10:26:00 Wednesday ET

Daron Acemoglu and James Robinson show that good inclusive institutions contribute to better long-run economic growth. Daron Acemoglu and James Robinson

2022-05-25 09:31:00 Wednesday ET

Net stock issuance theory and practice Net equity issuance can be in the form of initial public offering (IPO) or seasoned equity offering (SEO). This l