Alliqua BioMedical, Inc., incorporated on April 15, 2014, is a regenerative technology company that commercializes regenerative medical products which assist the body in the repair or replacement of soft tissue. The Company develops and manufactures electron-beam cross-linked sheet gels. It serves manufacturers of medical devices, cosmeceuticals, and other commercial product applications. Its hydrogel platform technology allows manufacturing electron-beam cross-linked sheet gels with or without active ingredients. Through its platform, the Company delivers prescription or over-the-counter medications, ingredients for wound healing and skin care, or other materials. It provides custom hydrogels to the original equipment manufacturer market. The Company utilizes hydrogel technology through which hydrogels are manufactured by introducing a hydrophilic polymer into water to create a feed mix. ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-02-28 10:27:00 Tuesday ET

Basic income reforms can contribute to better health care, public infrastructure, education, technology, and residential protection. Philippe Van Parijs

2020-06-17 09:23:00 Wednesday ET

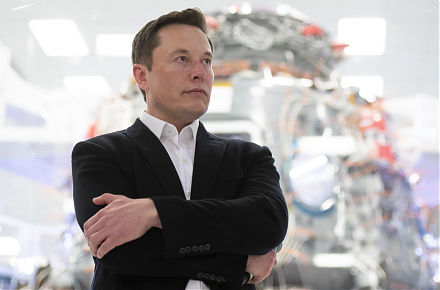

Successful founders focus on their continuous growth, passion, perseverance, and the collective wisdom of most team members. William Ferguson (2013) &

2019-01-03 10:38:00 Thursday ET

American parents often worry about money and upward mobility for their children. A recent New York Times survey suggests that nowadays American parents spen

2023-06-28 09:29:00 Wednesday ET

Carmen Reinhart and Kenneth Rogoff delve into several centuries of cross-country crisis data to find the key root causes of financial crises for asset marke

2018-03-29 14:28:00 Thursday ET

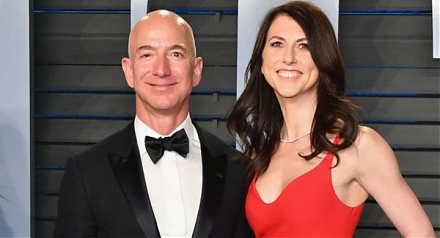

Share prices tumble for technology stocks due to Trump's criticism of Amazon's tax avoidance, Facebook user data breach of trust, and Tesla autopilo

2018-01-03 08:38:00 Wednesday ET

President Trump targets Amazon in his call for U.S. Postal Service to charge high delivery prices on the ecommerce giant. Trump picks another fight with an