2019-07-15 16:37:00 Mon ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

President of US-China Business Council Craig Allen states that a trade deal should be within reach if Trump and Xi show courage at G20. A landmark trade agreement between China and the U.S. should be attainable insofar as Presidents Trump and Xi have the courage to compromise on some particular aspects of the trade deal. This compromise can be difficult for both leaders, whereas, both sides signal the positive intent that Sino-U.S. trade negotiations should get back on track.

Allen indicates that setbacks are quite normal in most bilateral trade negotiations. Perhaps the China-U.S. trade envoys, Liu He and Robert Lighthizer, seem to agree to a major trade deal *in principle*. However, the legal details may not fully reflect mutual agreement for both presidential leaders. The Trump administration calls for significant bilateral trade deficit removal and better intellectual property protection and enforcement in China. Yet, the Chinese Xi administration expects all future fair trade practices to be realistic with reasonable product procurement, market access, and technology transfer etc. Respecting these fundamental interests can help both sides reach a tractable solution. In essence, Allen suggests that addressing these concerns helps China achieve sustainable economic growth in the long run.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-05-27 08:33:00 Sunday ET

The Federal Reserve proposes softening the Volcker rule that prevents banks from placing risky bets on securities with deposit finance. As part of the po

2018-01-17 05:30:00 Wednesday ET

European Union antitrust regulators impose a fine on Qualcomm for advancing its key exclusive microchip deal with Apple to block out rivals such as Intel an

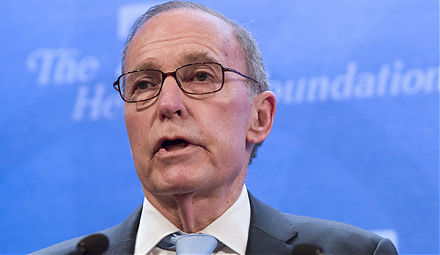

2018-08-13 12:39:00 Monday ET

White House chief economic adviser Larry Kudlow points out that the recent U.S. dollar strength shows a clear sign of investor confidence and optimism. Gree

2019-10-21 10:35:00 Monday ET

American state attorneys general begin bipartisan antitrust investigations into the market power and corporate behavior of central tech titans such as Apple

2019-03-13 12:35:00 Wednesday ET

Uber seeks an IPO in close competition with its rideshare rival Lyft and other tech firms such as Slack, Pinterest, and Palantir. Uber expects to complete o

2018-04-20 10:38:00 Friday ET

Allianz chairman Mohamed El-Erian bolsters a new American economic paradigm in lieu of the Washington consensus. The latter dominates the old school of thou