American Capital Agency Corp. was organized on January 7, 2008, and commenced operations on May 20, 2008 following the completion of its initial public offering ('IPO'). It is a REIT that invests exclusively in residential mortgage pass-through securities and collateralized mortgage obligations on a leveraged basis. These investments consist of securities for which principal and interest are guaranteed by government-sponsored entities such as Fannie Mae and Freddie Mac, or by a U.S. Government agency such as Ginnie Mae. The Company refers to these types of securities as agency securities and the specific agency securities in which it invests as its investment portfolio. It is externally managed by American Capital Agency Management, LLC ('Manager'). The Company's Manager is a wholly-owned subsidiary of American Capital, LLC, which is a wholly-owned portfolio company of American Capital. The Company's principal objective is to generate net income for distribution to its stockholders through regular quarterly dividends from its net interest income, which is the spread between the interest income earned on its investment portfolio and the interest costs of its borrowings and hedging activities, and realized gains on its investments. The agency securities in which it invests consist of residential pass-through certificates and collateralized mortgage obligations ('CMOs'), for which the principal and interest payments are guaranteed by a U.S. Government agency or U.S. Government-sponsored entity. Residential pass-through certificates are securities representing interests in 'pools' of mortgage loans secured by residential real property where payments of both interest and principal, plus pre-paid principal, on the securities are made monthly to holders of the securities, in effect 'passing through' monthly payments made by the individual borrowers on the mortgage loans that underlie the securities, net of fees paid to the issuer/guarantor and servicers of the securities. CMOs are structured instruments representing interests in residential pass-through certificates. In acquiring agency securities, it competes with other mortgage REITs, mortgage finance and specialty finance companies, savings and loan associations, banks, mortgage banks, insurance companies, mutual funds, institutional investors, investment banking firms, other lenders, governmental bodies and other entities....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2017-10-27 06:35:00 Friday ET

Leon Cooperman, Chairman and CEO of Omega Advisors, points out that the current Trump stock market rally now approaches normalization. The U.S. stock market

2025-03-03 04:11:06 Monday ET

Is higher stock market concentration good or bad for Corporate America? In recent years, S&P 500 stock market returns exhibit spectacular concentrati

2019-07-13 07:17:00 Saturday ET

Japanese prime minister Shinzo Abe outlines the main economic priorities for the G20 summit in Osaka, Japan. First, Asian countries need to forge the key Re

2018-02-07 06:38:00 Wednesday ET

The new Fed chairman Jerome Powell faces a new challenge in the form of both core CPI and CPI inflation rate hikes toward 1.8%-2.1% year-over-year with stro

2019-04-17 11:34:00 Wednesday ET

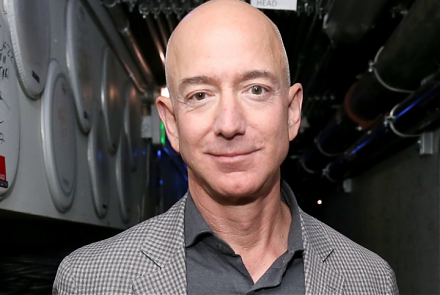

Amazon CEO Jeff Bezos admits the fact that antitrust scrutiny remains a primary imminent threat to his e-commerce business empire. In his annual letter to A

2024-10-31 09:26:00 Thursday ET

Generative artificial intelligence (Gen AI) uses large language models (LLM) and content generation tools to enhance human lives with better productivity.