AltEnergy Acquisition Corp. is a blank check company. It intends to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or related business combination with one or more businesses. AltEnergy Acquisition Corp. is based in New York....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-06-03 11:31:00 Monday ET

The Sino-U.S. trade war may be the Thucydides trap or a clash of Caucasian and non-Caucasian civilizations. The proverbial Thucydides trap refers to the his

2019-08-18 11:33:00 Sunday ET

House Judiciary Committee summons senior executive reps of the tech titans to assess online platforms and their market power. These companies are Facebook,

2025-10-31 12:26:00 Friday ET

With respect to wider weight loss treatment and obesity treatment, the global market for GLP-1 medications now grows substantially to benefit more than 1 bi

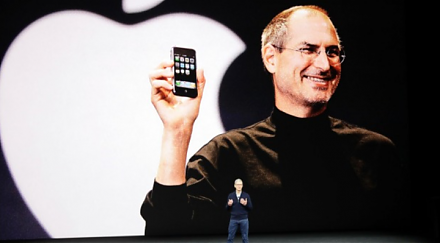

2018-06-25 12:43:00 Monday ET

Apple and Samsung are the archrivals for the title of the world's top smart phone maker. The recent patent lawsuit settlement between Apple and Samsung

2019-05-07 09:30:00 Tuesday ET

The Trump team receives a 3.2% first-quarter GDP boost as Fed Chair Jay Powell halts the next interest rate hike in early-May 2019. This smooth upward econo

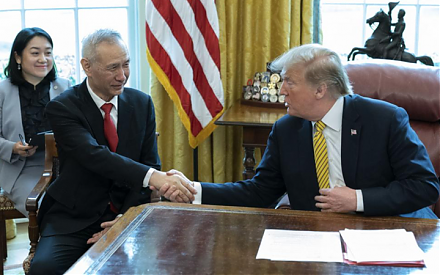

2019-11-03 12:30:00 Sunday ET

Chinese trade delegation offers to boost purchases of U.S. agricultural products to reach an interim trade deal with the Trump administration. Chinese Vice