Advent Technologies Inc. involved in the fuel cell and hydrogen technology space. The company accelerate electrification through advanced materials, components and fuel cell technology. Its technology applies to electrification and energy storage markets. Advent Technologies Inc., formerly known as AMCI Acquisition Corp., is based in CAMBRIDGE, Mass....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-08-27 09:35:00 Monday ET

President Trump and his Republican senators and supporters praise the recent economic revival of most American counties. The Economist highlights a trifecta

2019-03-17 14:35:00 Sunday ET

U.S. trade rep Robert Lighthizer proposes America to require regular touchpoints to ensure Sino-U.S. trade deal enforcement. America has to maintain the thr

2019-03-19 12:35:00 Tuesday ET

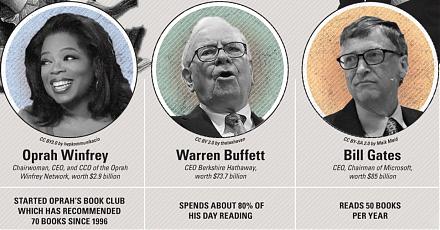

U.S. tech titans increasingly hire PhD economists to help solve business problems. These key tech titans include Facebook, Amazon, Microsoft, Google, Apple,

2025-02-02 11:28:00 Sunday ET

Our proprietary alpha investment model outperforms most stock market indexes from 2017 to 2025. Our proprietary alpha investment model outperforms the ma

2019-03-11 10:32:00 Monday ET

Lyft seeks to go public with a dual-class stock ownership structure that allows the co-founders to retain significant influence over the rideshare tech unic

2022-04-25 10:34:00 Monday ET

Corporate ownership governance theory and practice The genesis of modern corporate governance and ownership studies traces back to the seminal work