American Campus Communities, Inc. is a real estate investment trust (`REIT`). Through ACC's controlling interest in American Campus Communities Operating Partnership L.P. (`ACCOP`), ACC is one of the largest owners, managers and developers of high quality student housing properties in the United States in terms of beds owned and under management. ACC is a fully integrated, self-managed and self-administered equity REIT with expertise in the acquisition, design, financing, development, construction management, leasing and management of student housing properties....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 12 July 2025

2024-02-04 08:28:00 Sunday ET

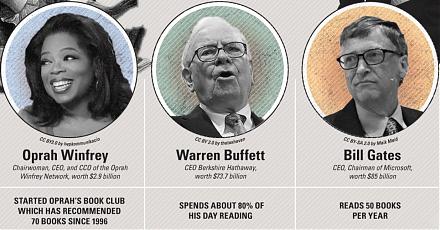

Our proprietary alpha investment model outperforms most stock market indexes from 2017 to 2024. Our proprietary alpha investment model outperforms the ma

2023-06-21 12:32:00 Wednesday ET

Michael Sandel analyzes what money cannot buy in stark contrast to the free market ideology of capitalism. Michael Sandel (2013) What money

2018-10-23 12:36:00 Tuesday ET

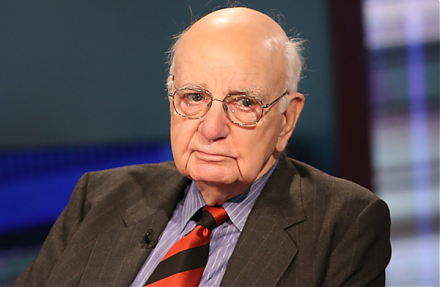

Former Fed Chair Paul Volcker releases his memoir, talks about American public governance, and worries about plutocracy in America. Volcker suggests that pu

2019-01-07 18:42:00 Monday ET

Neoliberal public choice continues to spin national taxation and several other forms of government intervention. The key post-crisis consensus focuses on go

2019-01-10 17:31:00 Thursday ET

The recent Bristol-Myers Squibb acquisition of American Celgene is the $90 billion biggest biotech deal in history. The resultant biopharma goliath would be

2020-03-26 10:31:00 Thursday ET

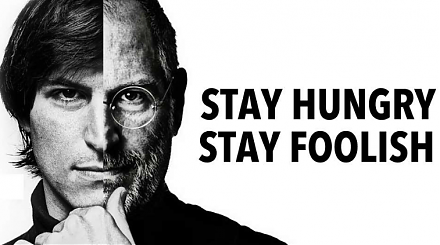

The unique controversial management style of Steve Jobs helps translate his business acumen into smart product development. Jay Elliot (2012) Leading