Atlantic Coastal Acquisition Corp. II is a blank check company. It intends to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or related business combination with one or more businesses. Atlantic Coastal Acquisition Corp. II is based in New York....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-12-08 08:28:00 Friday ET

Tax policy pluralism for addressing special interests Economists often praise as pluralism the interplay of special interest groups in public policy. In

2019-01-06 08:39:00 Sunday ET

President Trump signs an executive order to freeze federal employee pay in early-2019. Federal employees face furlough or work without pay due to the govern

2025-09-21 12:32:00 Sunday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2025-09-13 12:23:00 Saturday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2017-04-07 15:34:00 Friday ET

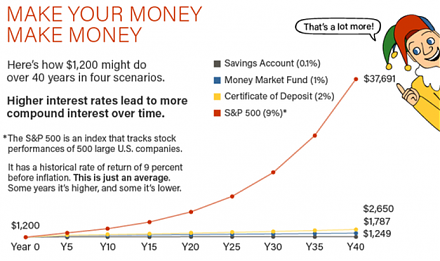

Would you rather receive $1,000 each day for one month or a magic penny that doubles each day over the same month? At first glance, this counterintuitive

2019-02-05 10:32:00 Tuesday ET

President Trump remains optimistic about the Sino-American trade war resolution of both trade deficit eradication and tech transfer enforcement. Trump now s