Arbutus Biopharma Corporation is a biopharmaceutical company which is focused on discovering, developing and commercializing a portfolio of drug candidates for chronic hepatitis B infection. The Company's products include TKM-HBV, Cyclophilin Inhibitor-OCB-030, TLR9 Agonist (CYT-003), Capsid Assembly Inhibitors, Surface Antigen Secretion Inhibitors, STING Agonists, cccDNA Formation Inhibitors, cccDNA Epigenetic Modifiers, TKM-PLK1, GI-NET and ACC, HCC, TKM-Ebola, TKM-Ebola-Guinea, TKM-Marburg, TKM-HTG and TKM-ALDH which are in different clinical trial stage. Arbutus Biopharma Corp, formerly known as Tekmira Pharmaceuticals Corporation, is headquartered in Vancouver, BC....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2020-04-24 11:33:00 Friday ET

Disruptive innovations tend to contribute to business success in new blue-ocean markets after iterative continuous improvements. Clayton Christensen and

2022-08-30 10:32:00 Tuesday ET

The financial services industry needs fewer banks worldwide. As long as banks have existed in human history, their managers have realized how not all dep

2019-08-26 11:30:00 Monday ET

Partisanship matters more than the socioeconomic influence of the rich and elite interest groups. This new trend emerges from the recent empirical analysis

2018-09-11 18:36:00 Tuesday ET

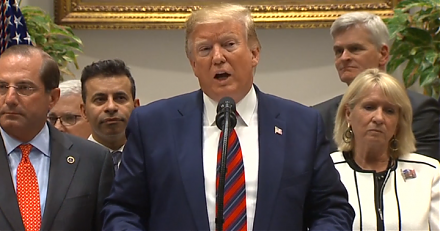

President Trump tweets that Apple can avoid tariff consequences by shifting its primary supply chain from China to America. These Trump tariffs on another $

2019-05-11 10:28:00 Saturday ET

The Trump administration still expects to reach a Sino-U.S. trade agreement with a better mechanism for intellectual property protection and enforcement. Pr

2018-07-19 18:38:00 Thursday ET

Goldman Sachs chief economist Jan Hatzius proposes designing a new Financial Conditions Index (FCI) to be a weighted-average of interest rates, exchange rat